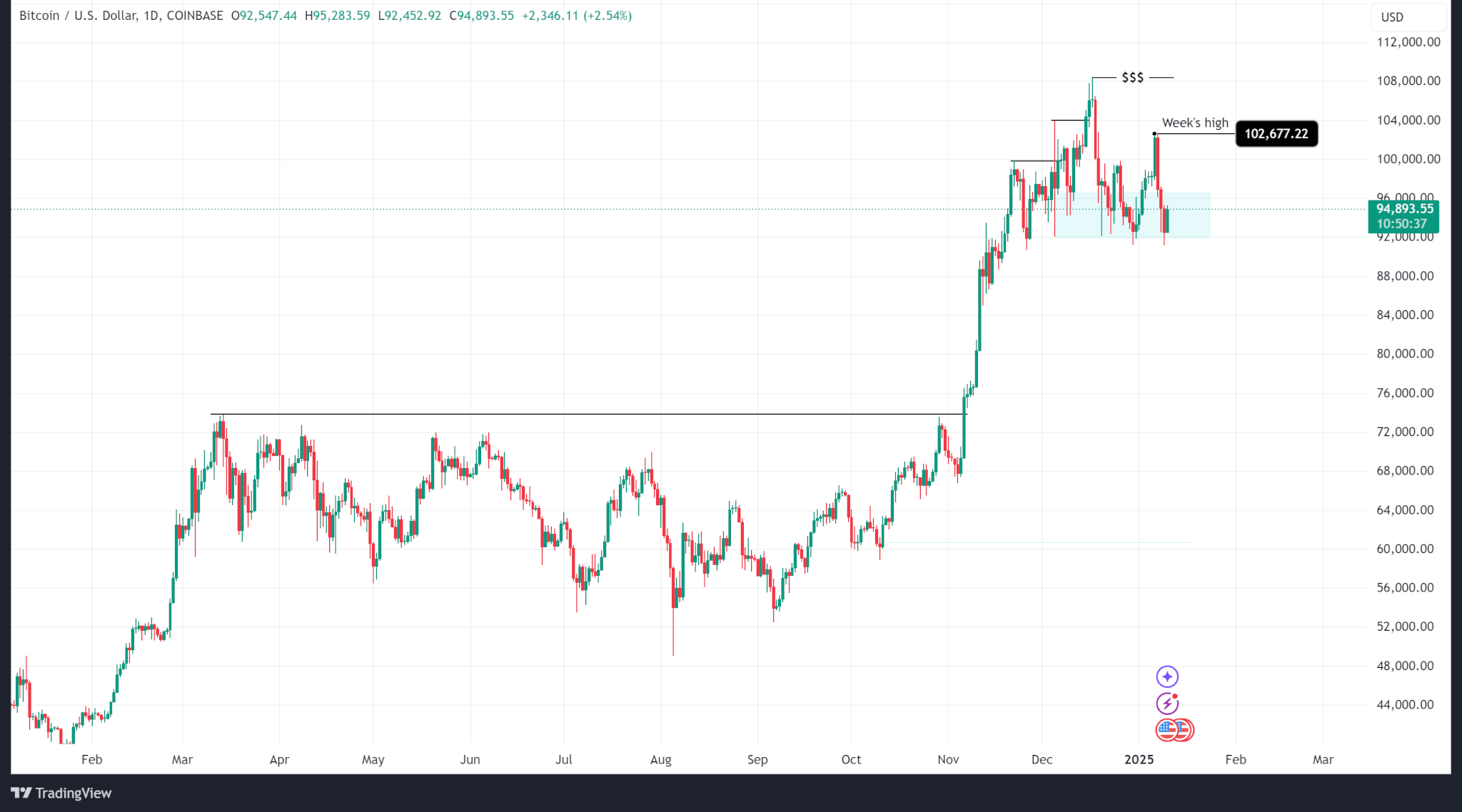

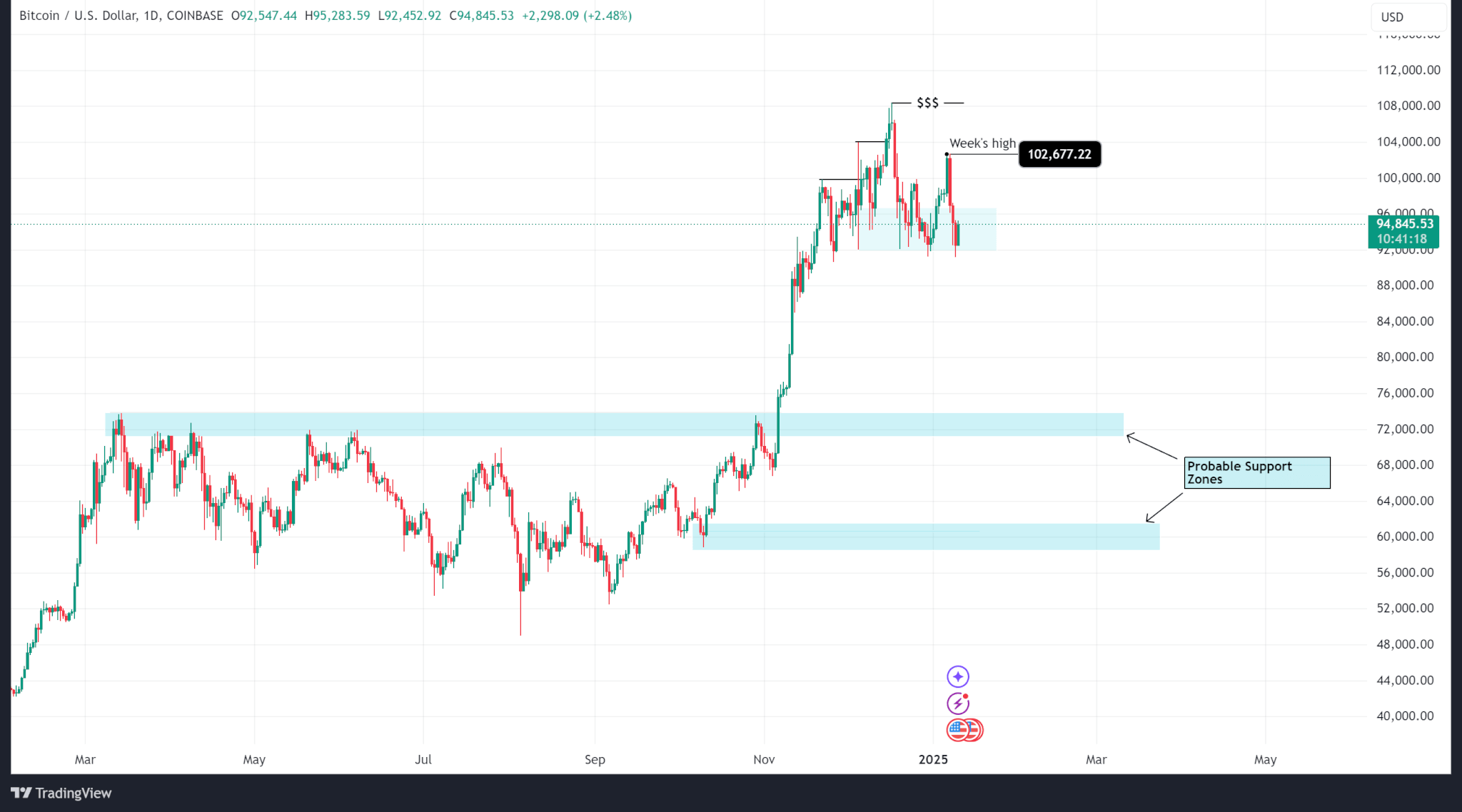

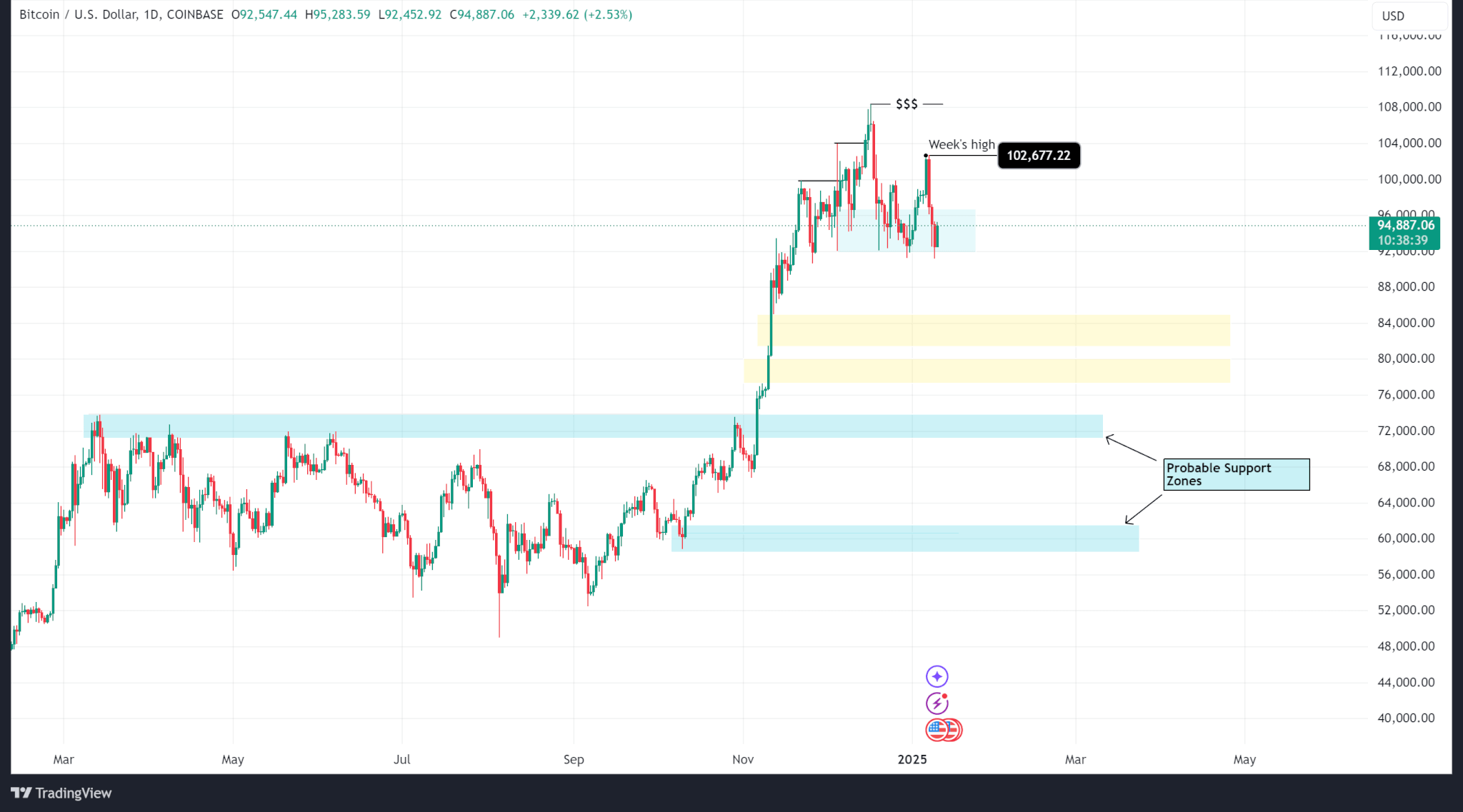

- Bitcoin’s new high surpasses its previous all-time high of $108,000 reached in December

- President-elect Donald Trump was once critical of Bitcoin, claiming it seemed “like a scam”

- On the eve of his inauguration, Trump and Melania Trump launched their memecoins

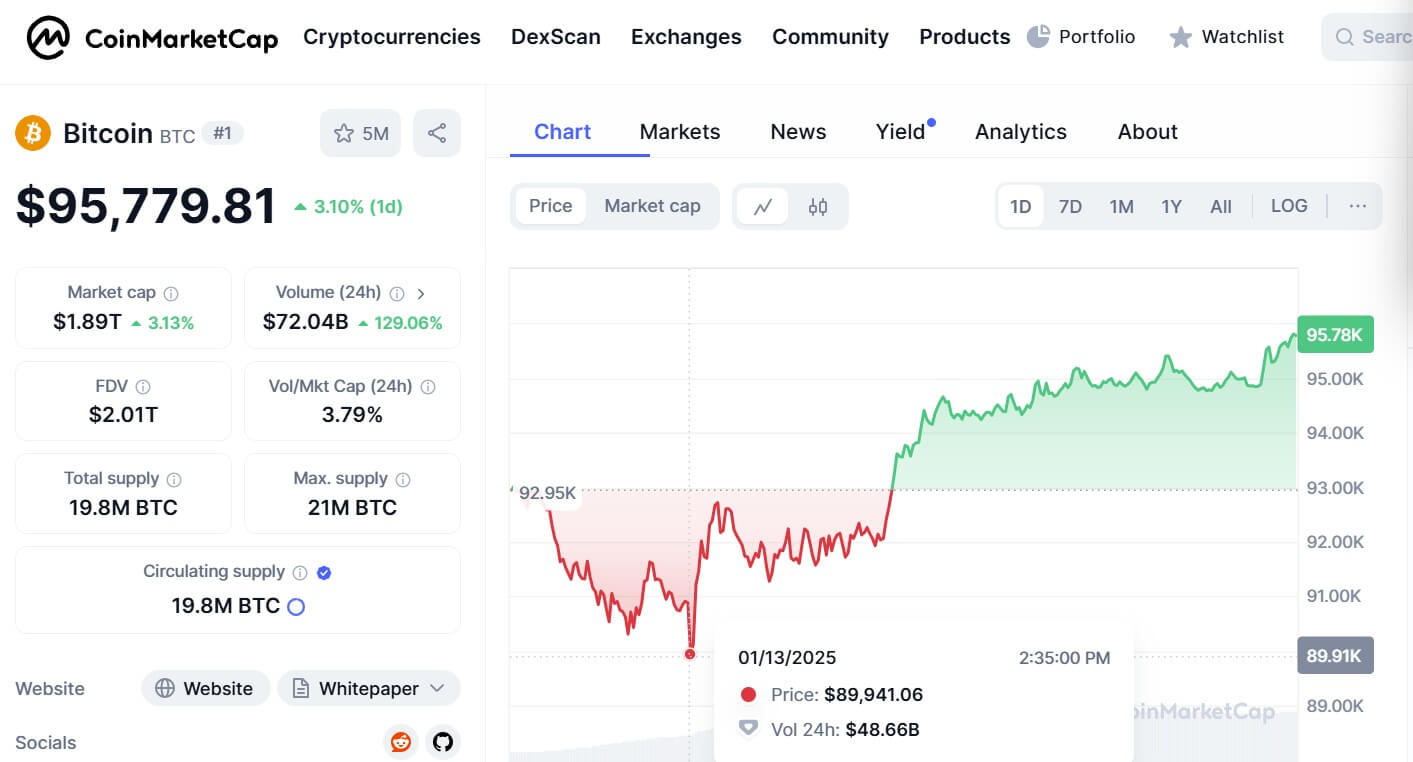

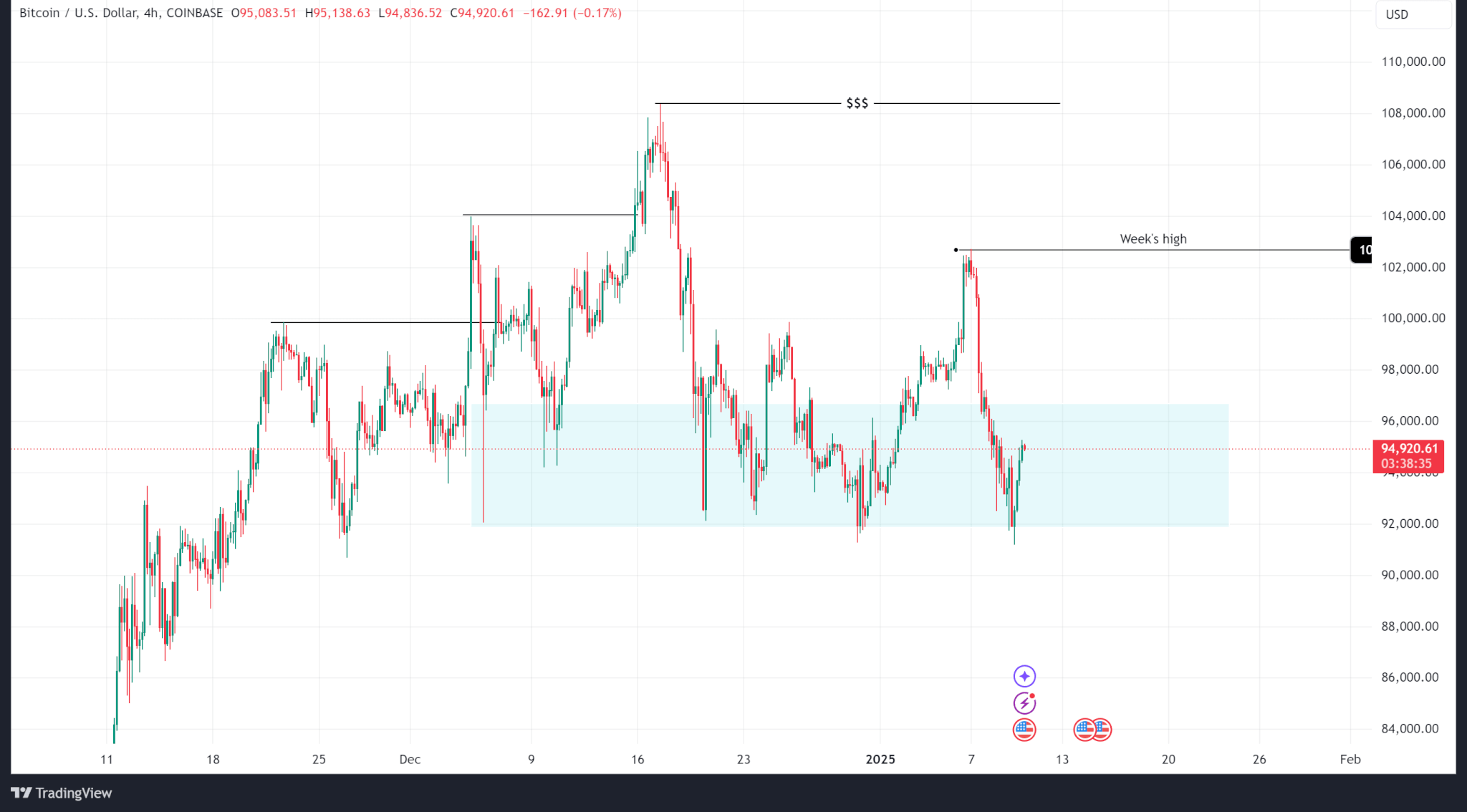

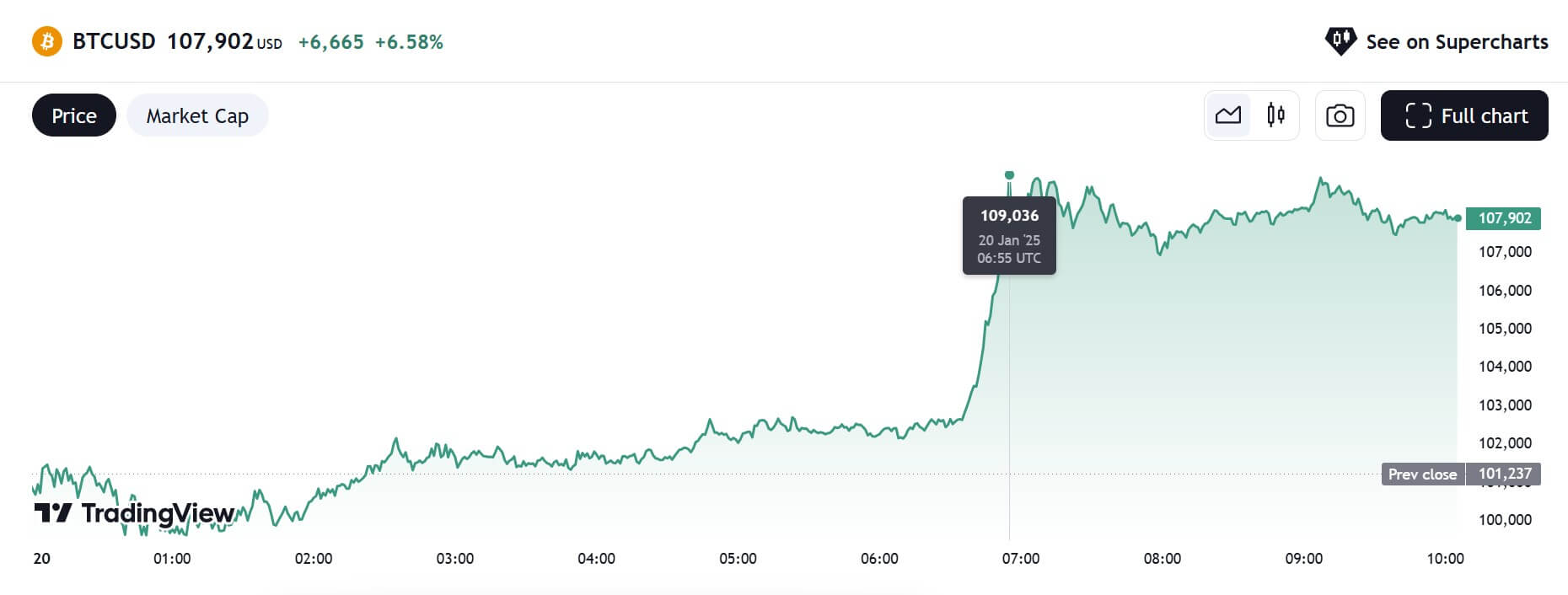

Bitcoin soared to new heights, hitting over $109,000 ahead of President-elect Donald Trump’s inauguration.

The number one crypto asset reached its all-time high on January 20 as market sentiment remains optimistic about Trump’s plans for the crypto industry. The new high surpasses its previous record of more than $108,000 achieved in December.

Data from TradingView shows Bitcoin topped $109,036 around 6:55 am before dropping to $107,000 a few minutes later.

Trump mentioned Bitcoin in a Sunday speech, highlighting its record performance since the US election.

“Since the election, the stock market has surged and small business optimism has soared a record 41 points to a 39-year high,” Trump said. “Bitcoin has shattered one record high after another.”

Support for crypto

Once critical of Bitcoin who said that it “seems like a scam” a few years ago, Trump has since embraced crypto, showing his support for it during his presidential election.

During his campaign trail, he vowed to make the US the “crypto capital” of the world and has appointed several crypto-friendly candidates into his incoming administration. Some familiar names include Paul Atkins as the next US Securities and Exchange Commission (SEC) chair and crypto czar David Sacks.

Trump is also expected to sign an executive order prioritizing crypto when he enters the White House today.

On the eve of Trump’s inauguration, he launched his $TRUMP memecoin, which, at one point, was valued at $75 per coin, according to data from CoinMarketCap. At the time of publishing, it’s trading at $51 with a market cap of more than $10 billion.

Incoming First Lady Melania Trump also launched her memecoin, $MELANIA, which was trading at a high of $13. It has since dropped to $10 with a market cap of over $2 billion.