- MicroStrategy bought its latest Bitcoin between December 9, 2024, and December 15, 2024

- Last week, the company purchased 21,550 Bitcoin for $2.1 billion and the week before it bought 15,400 Bitcoin for $1.4 billion

- The Bitcoin buying spree comes as MicroStrategy will be added to the Nasdaq-100 Index on December 23

MicroStrategy has acquired an extra 15,350 Bitcoin worth around $1.5 billion in cash, pushing its total holdings to 439,000.

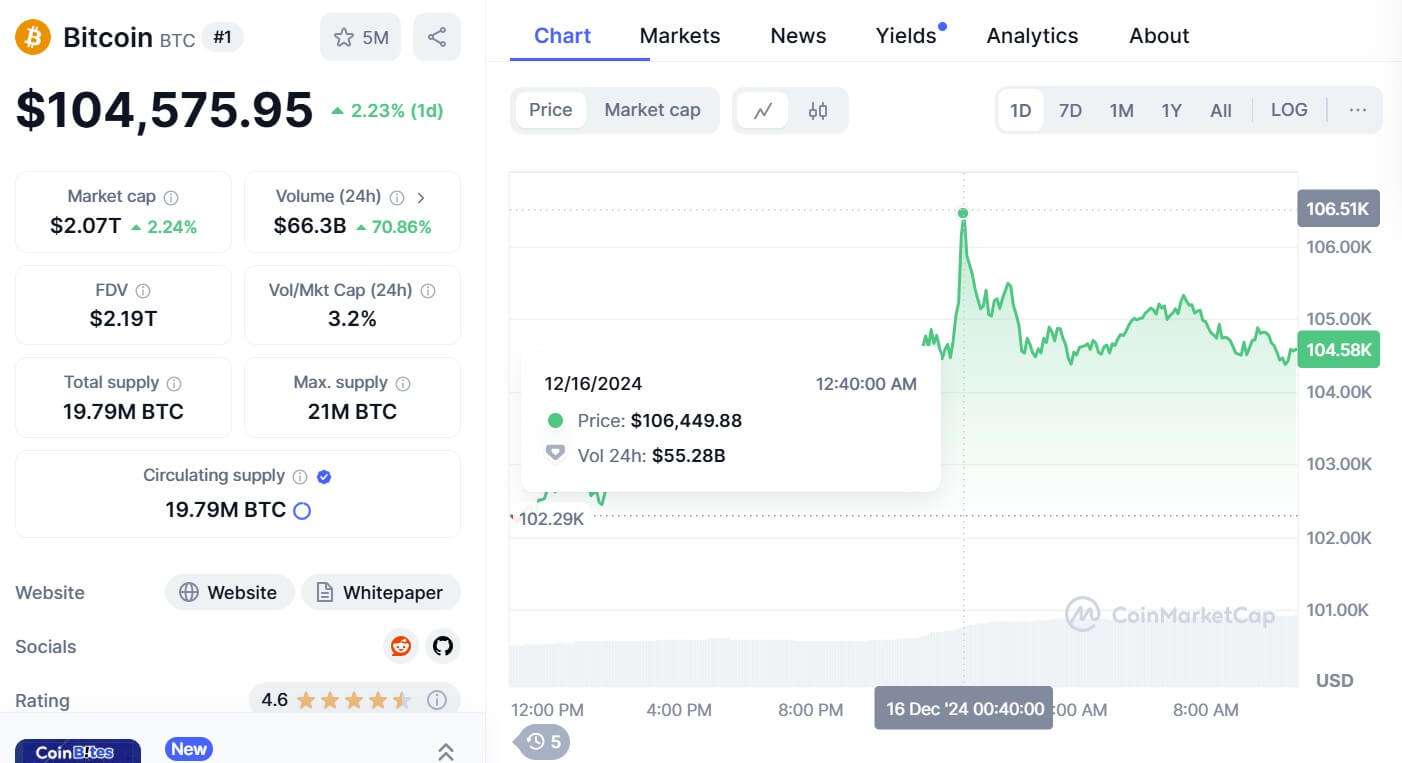

In an 8-K filing to the US Securities and Exchange Commission (SEC), MicroStrategy, a major Bitcoin holder, bought the crypto asset between December 9, 2024, and December 15, 2024, at an average price of $100,386 per Bitcoin.

With the latest Bitcoin addition, MicroStrategy and its subsidiaries now hold 439,000 Bitcoin, valued at $45 billion. In a post on X, Michael Saylor, MicroStrategy’s CEO, said the Bitcoin was bought for $27.1 billion or an average price of $61,725 per Bitcoin.

Saylor also noted that MicroStrategy’s year-to-date Bitcoin Yield is 72.4% while its quarter-to-date Bitcoin Yield is 46.4%.

MicroStrategy has acquired 15,350 BTC for ~$1.5 billion at ~$100,386 per #bitcoin and has achieved BTC Yield of 46.4% QTD and 72.4% YTD. As of 12/15/2024, we hodl 439,000 $BTC acquired for ~$27.1 billion at ~$61,725 per bitcoin. $MSTR https://t.co/SaWLNBVkrl

— Michael Saylor⚡️ (@saylor) December 16, 2024

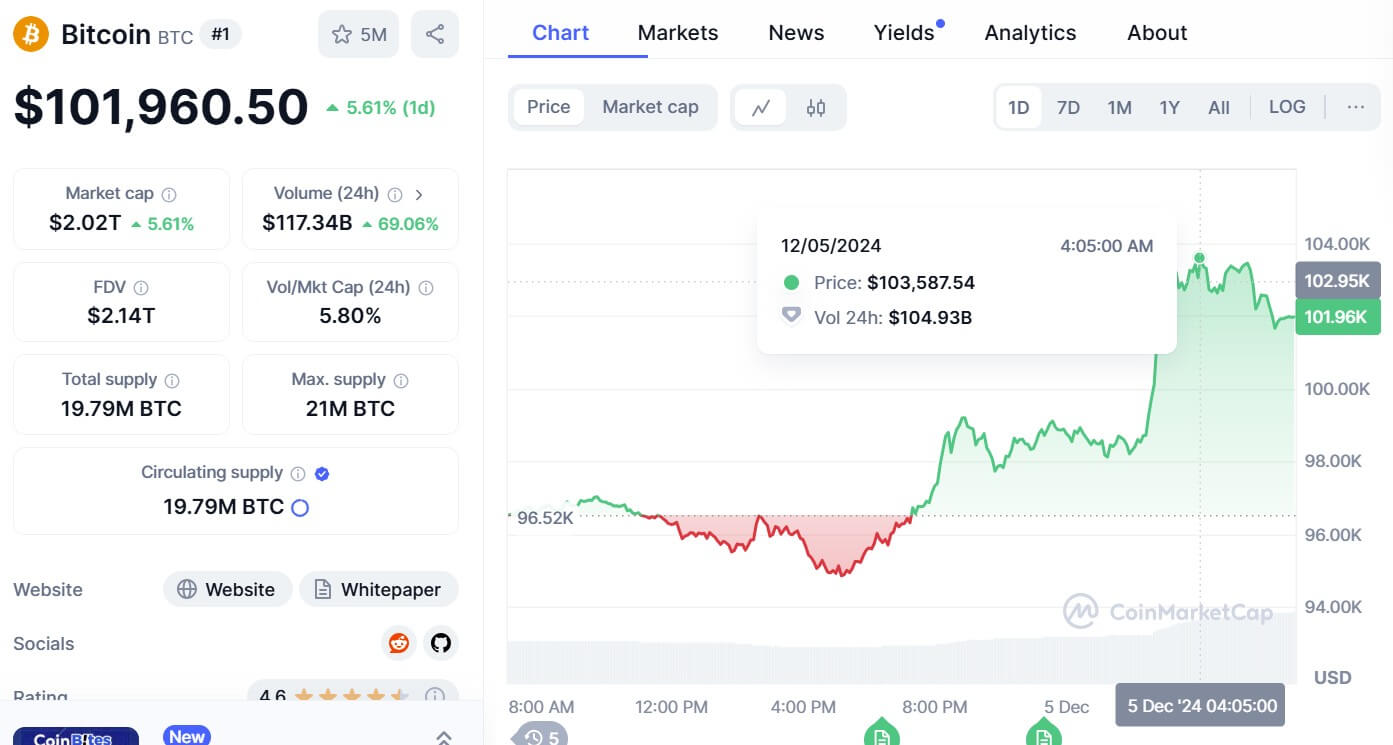

This is the latest purchase from MicroStrategy. Last week, the company purchased a further 21,550 Bitcoin between December 2, 2024, and December 8, 2024, for around $2.1 billion at an average price of $98,783 per Bitcoin. This followed a purchase of 15,400 Bitcoin for $1.4 billion the week before.

Joining the Nasdaq-100 Index

The continued push to buy more Bitcoin comes as MicroStrategy will be added to the Nasdaq-100 Index on December 23.

In an announcement on December 13 from Nasdaq, it said three companies will be added to its Index: Palantir Technologies Inc., MicroStrategy Incorporated, and Axon Enterprise, Inc.

Following the news, crypto analyst Will Clemente wrote on X: “Now that MSTR is getting added to the Nasdaq, every large pension fund, sovereign wealth fund, and individual retirement account in the world is going to have Bitcoin exposure.”

The news has also rallied MicroStrategy’s stock price, pushing it up 3%, according to CNBC.