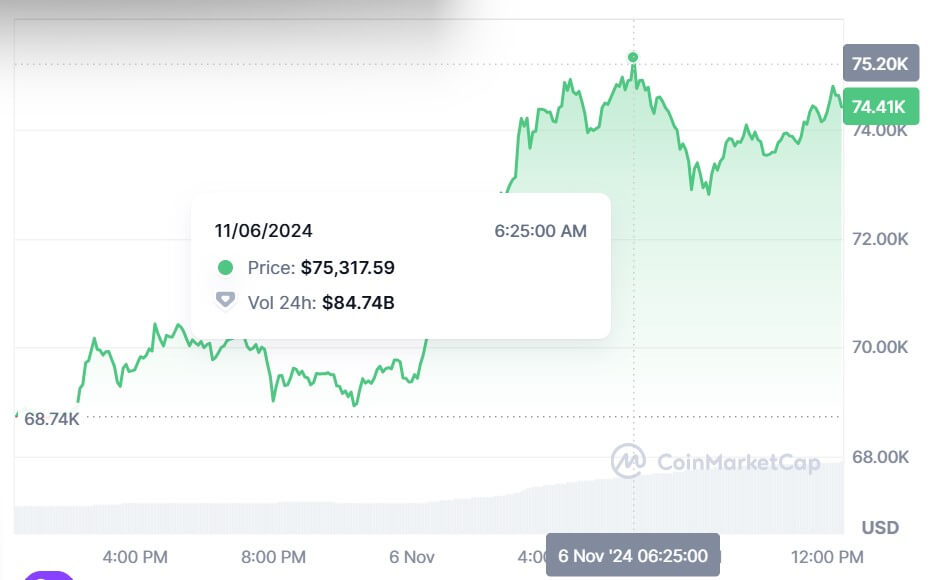

- Bitcoin reached a high of $75,317 in the early hours of this morning

- In September, Bernstein analysts predicted Bitcoin to reach between $80,000 and $90,000 by the end of 2024 if Trump won

- Unity’s COO said to CoinJournal said it was “disingenuous” to say Trump winning the US election was the sole reason Bitcoin’s price went up

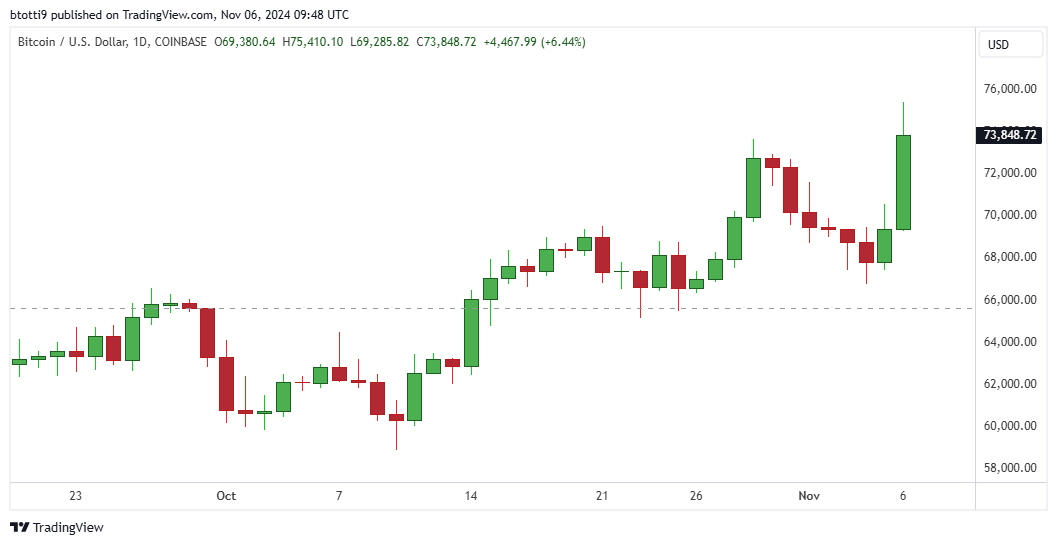

Bitcoin rose to a record high of over $75,000 early this morning as voting results signalled a Donald Trump win for the White House.

Data from CoinMarketCap shows Bitcoin achieved a high of $75,317 around 6:25 this morning. Before the election results started coming in last night, Bitcoin was trading at around $69,000.

However, as the evening progressed and into the early morning, Bitcoin continued an upward trajectory before reaching its new all-time high.

Bitcoin’s last all-time high took place in March when it reached $73,000.

Data from AP News shows Trump has taken 277 of the electoral results compared to Vice President and presidential candidate Kamala Harris’ 224.

Will the price rise continue?

While the new high comes amid the US election results, many will be wondering whether this upward movement will continue. In September, Bernstein analysts predicted that Bitcoin could reach between $80,000 and $90,000 by the end of 2024 if Trump won the presidential election.

According to James Toldeano, COO of self-custody wallet Unity, people need to realize that data based on the 2012, 2016, and 2020 US elections doesn’t reveal consistent patterns for the crypto market concerning election results.

“Some have looked at the 2020 election and seen the price rise from $13,760 prior to the election on November 1, to $19,698 following the election on December 1, and immediately asserted it was the election that drove the increase,” said Toldeano to Coinjournal.

In reality, Toldeano added, several factors contributed to the price rise, including US stimulus payments, increasing interest from companies like MicroStrategy buying Bitcoin, and people seeing Bitcoin as a safe investment during the Covid pandemic.

“While the election happened during this time, it’s disingenuous to say it directly caused the price increase,” he said.

In the long-term, it won’t be the election that moves the crypto market, but “broader macroeconomic events, technological advancements, shifting market sentiment, and factors outside of the next President’s control,” Toldeano explained.

Pro-crypto

Former US President Donald Trump has come across as more crypto-friendly compared to Harris.

Back in May, Trump promised that, if he was re-elected, he’d free Ross Ulbricht, the Silk Road creator. Ulbricht has already served 11 years in prison. In August, Trump also promised to make America the “crypto capital of the planet.”

In September, Trump became the first US president to use the Bitcoin network. He achieved this after sending a Bitcoin transaction at PubKey, a crypto-themed bar in New York ahead of his campaign rally in Long Island.

On the flip side, Harris has been muted about her stance on crypto despite saying her administration would support a crypto regulatory framework if she became the next US president.

“Incoming President Trump has the power to save crypto in the US where urgent change is needed,” said Jesper Johansen, CEO and founder of Northstake, an Ethereum staking marketplace, to Coinjournal.

“First amongst the new administration’s priorities should be to define staking as an opportunity for US investors,” Johansen continued. “The question still lingers: is staking a commodity or a security?”

Johansen said that $6 billion is sitting in Ethereum exchange-traded funds (ETFs), which aren’t being staked, meaning investors are missing out on economic opportunities. According to Johansen, this could be one of the reasons why the uptake of Ethereum ETFs hasn’t been as popular as Bitcoin ETFs.

“Once these core issues have been solved, changes are needed within the SEC to ensure that crypto is viewed as a vehicle of innovation, rather than something to be feared,” he added.

Ahead of the election, Trump said he’d remove Gary Gensler, chair of the US Securities and Exchange Commission (SEC); however, it remains to be seen whether this will happen because the SEC is an independent federal agency.

At the time of publishing, Bitcoin is trading at around $74,000.