TLDR

-

Bitcoin’s upcoming pre-halving event has set the tone for a rally.

-

The International Monetary Fund (IMF) warns of possible inflation in 2024, which can affect Bitcoin’s rally.

-

Crypto whales seeking ways to diversify their portfolios are looking to NuggetRush for considerable returns.

As the pioneering digital asset, the movements of Bitcoin ($BTC) can sway the entire crypto market, dictating trends and influencing investment strategies. Recently, the crypto community has been abuzz with talk of a Bitcoin rally, which has rekindled the industry’s excitement and curiosity.

Amidst this Bitcoin resurgence, the intersection of its rally with the trajectory of NuggetRush (NUGX) sets the stage for intriguing exploration by crypto whales. NuggetRush is a meme coin that distinguishes itself through its blend of gaming, real-world impact, and a passionate community. The project stands at the forefront of crypto innovation, using the allure of digital art, including non-fungible tokens (NFTs), in its gaming model.

In this article, we journey through the ripples created by this Bitcoin resurgence, specifically focusing on how the diversification of these crypto whales can impact top crypto coins like NuggetRush.

NuggetRush (NUGX): Embracing the GameFi gold rush

NuggetRush is a groundbreaking meme coin, setting itself apart through a captivating gamification approach that promises to redefine the cryptocurrency landscape. This means that, beyond the trading charts and price fluctuations, investors can engage in a dynamic gaming environment and enjoy an interactive experience. It’s an excellent opportunity for early supporters seeking top crypto coins with a real-world impact.

The native token of the cryptocurrency ICO, NUGX, has a total supply of 500 million. With an intriguing tokenomics structure, NuggetRush offers a presale that marks a pivotal step toward realizing the project’s growth. The ICO has an initial DeFi coin price of $0.10 per token and a proposed launch price of $0.020 following the five stages of the presale.

NuggetRush offers a virtual universe that guarantees an unforgettable experience. The project is a revolutionary blend of GameFi and adventure that immerses players in the heart of a virtual gold rush. Every mine you explore and every strategy you craft holds the promise of valuable treasures, making every gaming session a thrilling quest. It’s a place where memes and trending NFTs evolve into tangible value.

This cryptocurrency ICO doesn’t just stop at providing an immersive gaming experience. It’s built on the Ethereum blockchain, ensuring the highest security and transparency standards.

The game’s characters, including Maxwell Stoneforge, Marcus “Mack” McAllister, and Amelia “Mia” Gallagher, offer players a dynamic and diverse set of skills and attributes, doubling as collectible non-fungible tokens. Excitement is added to the gameplay with these trending NFTs.

>> Buy NuggetRush Now <<

Bitcoin ($BTC): Opportunities amidst the rally

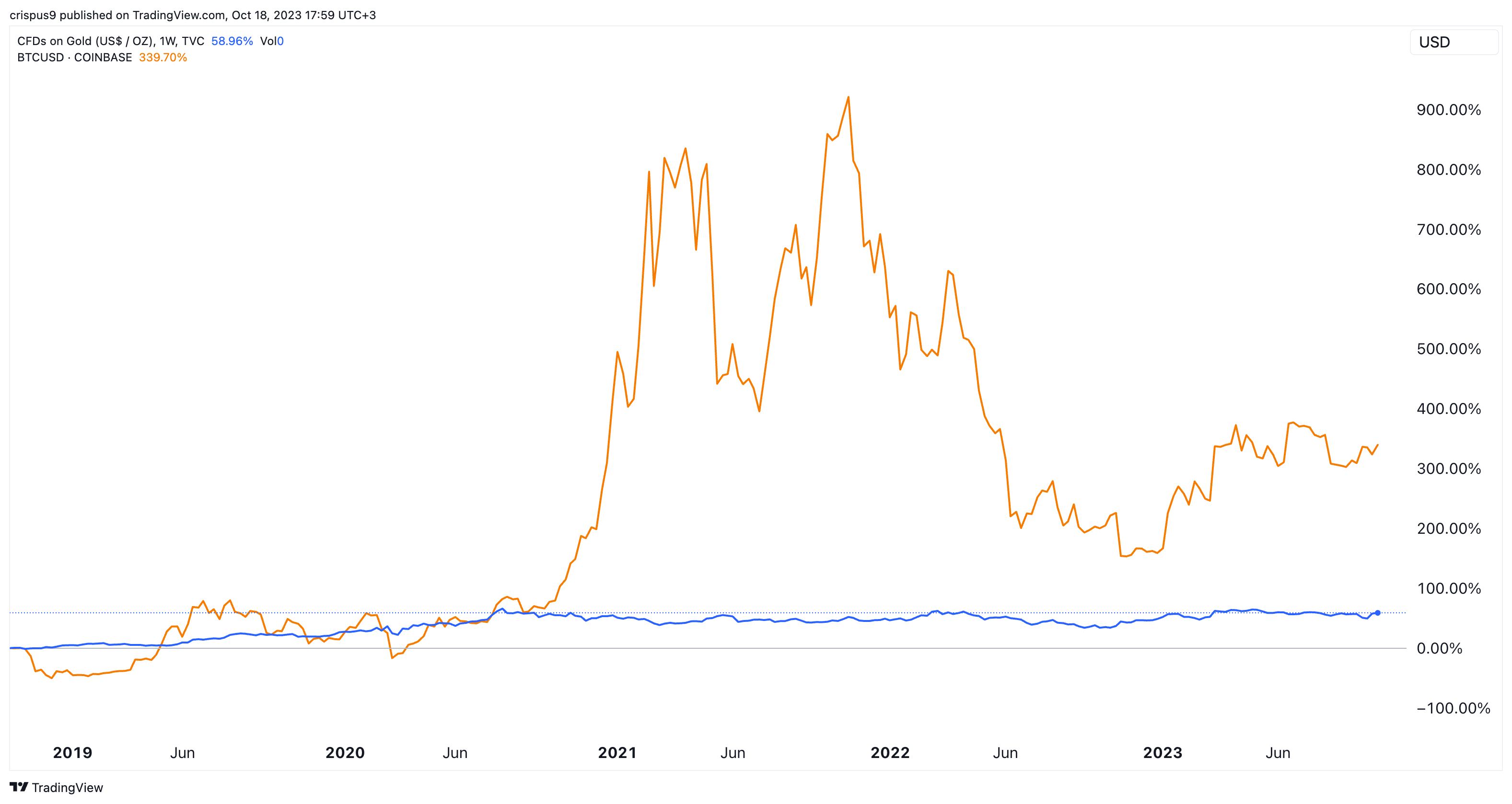

The recent Bitcoin rally has captured the attention of the cryptocurrency world, sparking intrigue and excitement. This surge in the value of the token’s DeFi coin price is driven by a complex interplay of factors, including its impending pre-halving event and the possibility of a Bitcoin ETF approval.

With these two factors, a change is definite for the cryptocurrency, although no one can tell which way the rally winds will blow. $BTC could skyrocket in price or decline further, especially following the IMF’s (International Monetary Fund) warning of inflation in 2024.

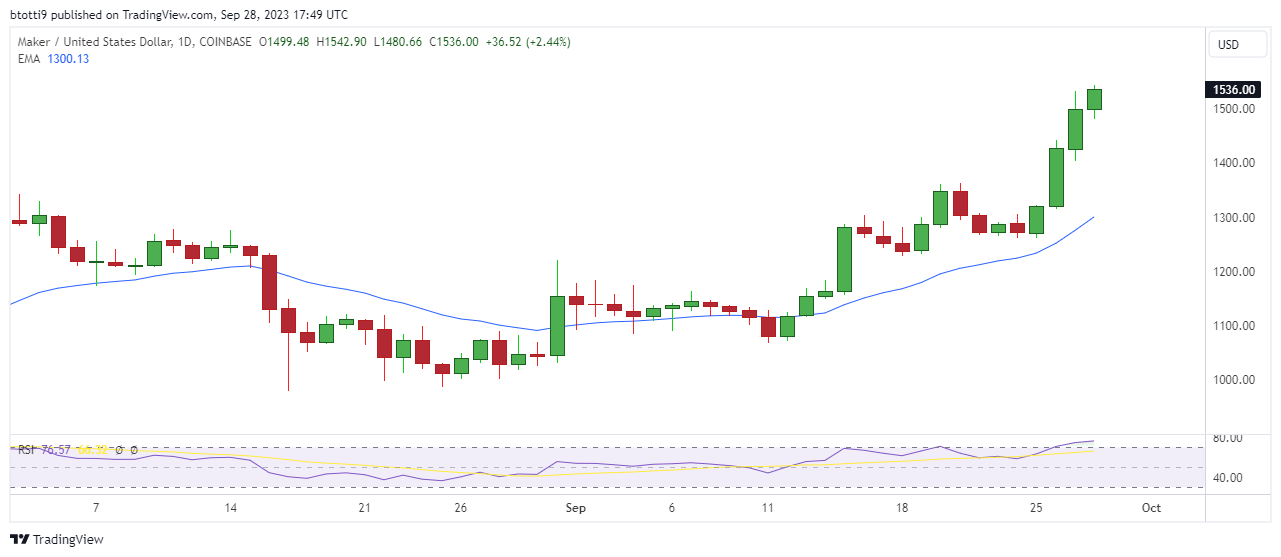

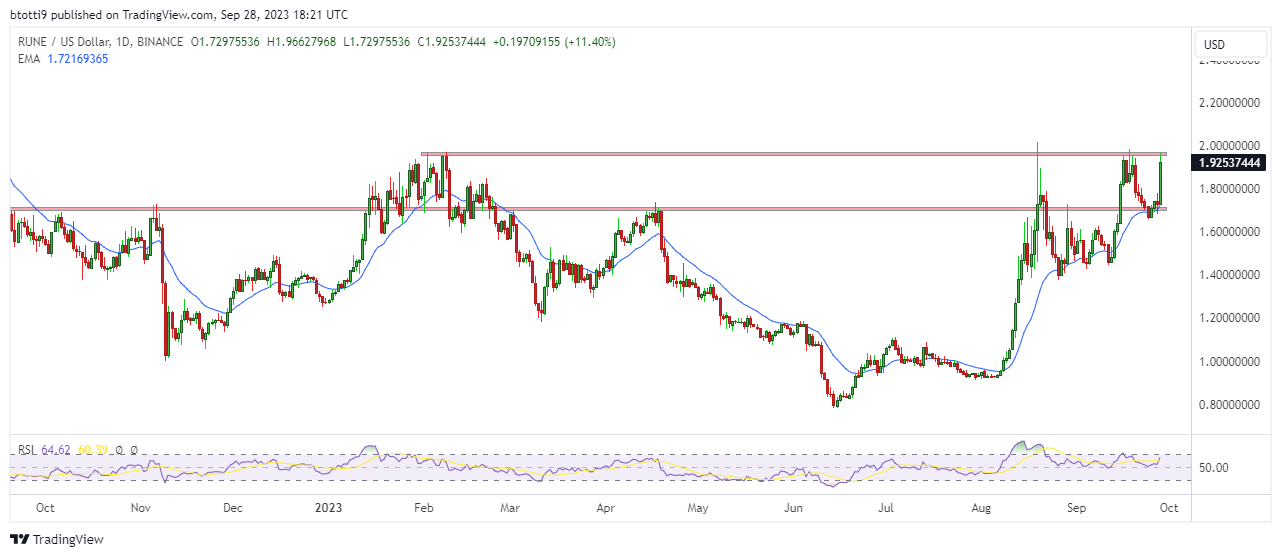

Cryptocurrency whales, individuals or entities holding substantial amounts of digital assets, have historically been known to wield considerable influence over the market. During bullish phases like the ongoing Bitcoin rally, these whales often diversify their portfolios, seeking new investment opportunities in tokens with incredible features like NUGX.

This behavior demonstrates faith in the continued growth of the crypto market and suggests a potential flow of capital into smaller tokens. This diversification also introduces a layer of unpredictability as the market landscape evolves, with benefits and challenges awaiting smaller tokens as they navigate the tidal wave of a $BTC rally.

With crypto whales diversifying to new tokens like NUGX, more growth opportunities are sure to arise for such projects and an influx of investors. These projects could potentially meet their goals quickly while gaining more partnerships.

>> Buy NuggetRush Now <<

Conclusion

The Bitcoin rally casts its influence far and wide, rippling the cryptocurrency market. As it surges, it illuminates the potential for diversified investments and ushers in fresh opportunities.

NuggetRush, with its unique blend of gaming, impact, and community, stands poised to navigate these dynamic waters. The synergy between Bitcoin’s resurgence and the innovative approach of NuggetRush hints at a promising journey ahead.

As the cryptocurrency landscape continues to evolve, one thing remains certain: the interplay of Bitcoin’s rally and tokens like NUGX exemplifies the dynamic nature of the crypto world, offering opportunities for investors and enthusiasts to explore and engage.

Visit NuggetRush Presale Website

Share this article

Categories

Tags