Key Takeaways

- Federal Reserve hikes 25 bps, Bitcoin drops over 6%

- Bounceback in prices follow, however, as market bets on rate cuts down the line

- Bitcoin originally fell to $26,700 and is now back at $27,700

- Tight monetary policy appears to be coming to a close, which is exactly what Bitcoin investors want to hear

- The flipside is that Bitcoin’s reputation may have been tarnished by the chaos in the industry over the last year

- Whether institutional money and Wall Street capital will trust crypto again remains to be seen

As has been the case over the last year now, Bitcoin continues to oscillate wildly based off interest rate expectations.

The orange coin took a tumble Wednesday off the back of the latest FOMC meeting, as interest rates were hiked 25 bps despite some analysts calling for a pause following the banking turmoil of recent weeks.

Why did Bitcoin fall?

Such has been the chaos in the banking markets, markets ahead of the meeting had priced in a genuine chance that rate hikes would be no more.

Silicon Valley Bank (SVB) triggered the crisis, which last week spread to Europe before the spectacular demise of Credit Suisse, the Swiss institution founded in 1856.

With deposits fleeing banks and markets reverberating, things were breaking – as they tend to do when rates are hiked hastily. And this past cycle has been the most rapid form of tightening in recent memory.

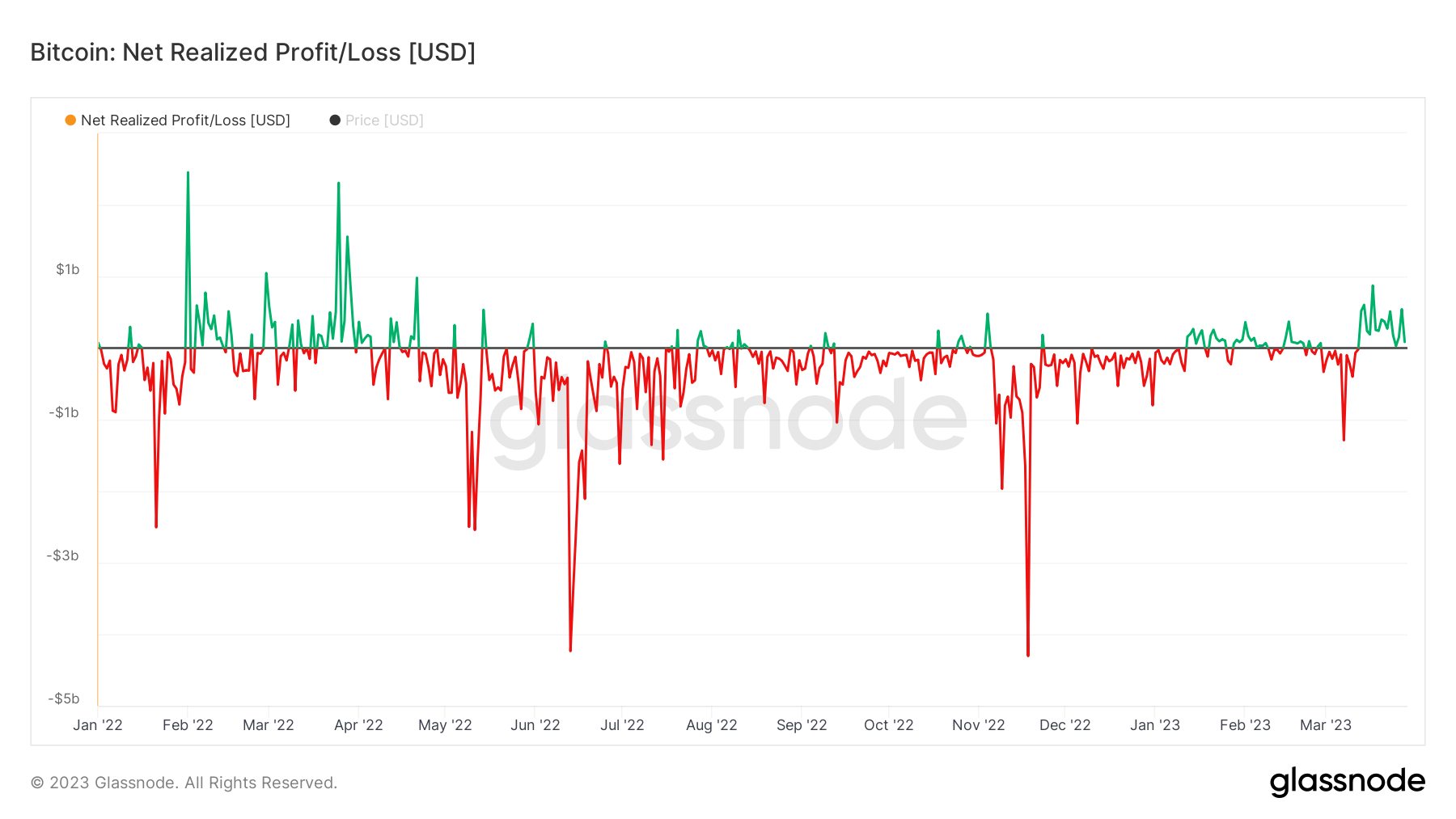

Bitcoin fell from $28,500 to $26,700 as the Fed announced a 25 bps hike, a fall of 6.3%.

However, Bitcoin has since bounced back somewhat, trading at $27,600. This came as the market began digesting the discourse from Fed chair Jerome Powell around the future path of interest rates.

While the hike did come yesterday, it feels increasingly certain that tight monetary policy is coming to a close. It is worth remembering that before SVB’s demise, this hike was virtually guaranteed to be 50 bps.

And looking out to rates by the end of July, the market is forecasting cuts rather than hikes. So while the 25 bps hike may have been hawkish, the language afterwards and conclusion coming out of the meeting was very much the opposite.

Will Bitcoin go up?

The question on everybody’s lips within crypto is then what does this mean for Bitcoin’s price? As always, it’s a difficult question to answer, but the future undoubtedly looks brighter for the coin today than it did a few months ago, that is for certain.

Not only is further removed from the scandal of FTX and the wave of bankruptcies that followed the sordid collapse of the former tier-1 exchange, but the end appears nigh with regard to the tight monetary policy.

Bitcoin was launched in 2009 and hence had never experienced anything other than a raging bull market in the wider economy. The S&P 500 increased seven-fold from the nadir of the GFC to its peak – and Bitcoin, alongside tech stocks, rode the wave of low interest rates, warm money printer and an all-around perfect climate.

As inflation roared last year, however, this flipped entirely. With interest rates hiked aggressively, there was no way for Bitcoin to sustain its previous levels of buoyancy. Down it came, and down it came hard.

Finally, it appears that the harsh monetary policy which has dragged it through the gutter is nearing an end. And while this doesn’t guarantee anything, it certainly removes the shackles so that there is at least a possibility that it raises.

Has Bitcoin’s image been tarnished?

The flip side of the argument is that the scale of the damage over the last year has been so substantial that Bitcoin’s long-term trajectory has been dampened, and it won’t be able to get on the same track.

Crypto winters have come and gone in the past, but this recent one coincided, like we said, with a rout in the wider economy for the first time ever. It also came while Bitcoin was a mainstream financial asset – something which wasn’t true in previous cycles.

Collapses like FTX, LUNA and Celsius not only pillaged capital out of the space, but embarrassed crypto on the big stage, as unfair as that is to the good players in the industry. Will institutional funds and trad-fi money be happy to trust crypto again?

It’s an interesting debate, and only time will tell.

Share this article

Categories

Tags