With Bitcoin’s price making a resurgence, investors are gearing up for a bull market in 2023. Crypto signal providers are seeing renewed interest thanks to their ability to save investors time and money by pinpointing the best entries. Many savvy traders continue to recommend AltSignals as the go-to platform.

Thanks to its sterling reputation, AltSignals’ recently announced ASI token presale is expected to be huge. In this article, you’ll find out why AltSignals is so highly regarded and why its ASI token could elevate the online trading experience for investors all across the globe.

Bitcoin Price Revitalized, Prompting Investors To Check Out AltSignals

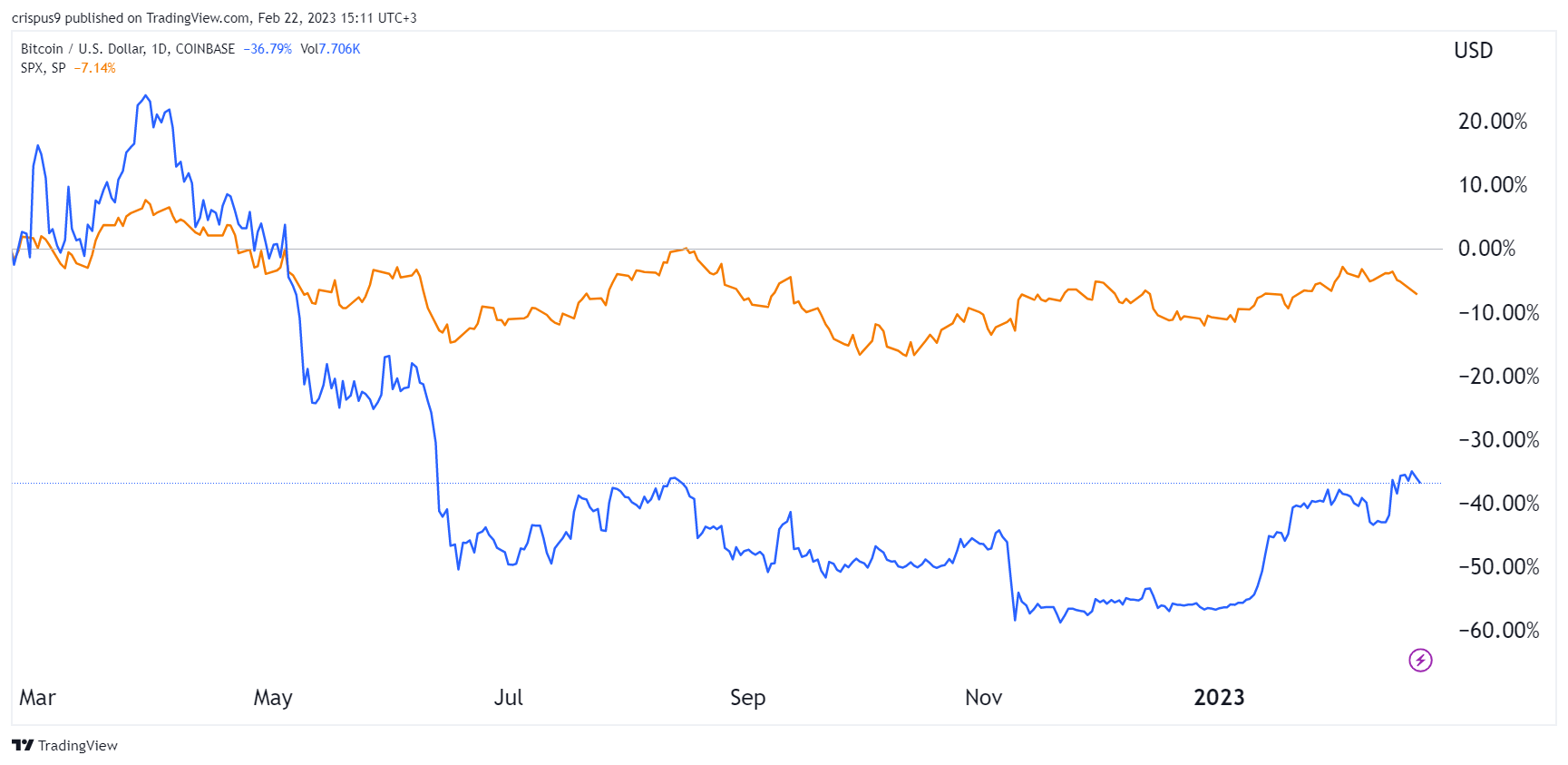

It seems like a risk-on mood is back in the markets. With the Fed expected to slow down or reverse interest rate hikes this year, investors have been loading up on crypto before the next bull cycle begins.

Since the start of 2023, Bitcoin’s price has risen almost 47% from around $16,500 to a high of approximately $24,250 in early February. This rapid ascension in Bitcoin’s price has accompanied a surge in interest in online trading, leading many investors to start looking for the best crypto signal providers to boost their profits. One name that has regularly cropped up is AltSignals.

What Is AltSignals?

AltSignals is a leading name in the crypto signals industry, established in 2017. It uses a team of market experts and professional traders to combine technical and fundamental analysis with its in-house algorithm, AltAlgo™. As a result, AltSignals has earned a reputation as one of the most reliable and profitable signal providers out there.

This reputation is quickly validated when looking over their stats. Over 52,000 traders rely on the 3,700 trade calls it has produced since its launch, with the platform holding a 4.9/5 rating on Trustpilot after receiving nearly 500 positive reviews. The actual trading results speak for themselves: AltSignals has returned over 10,000% in 19 out of 32 months on record.

AltSignals’ ASI token is projected to attract a new wave of attention to the AltSignals platform. This is due to the excellent benefits ASI will offer holders that will help them make the most out of their online trading journey.

How Is ASI Expected To Change the Online Trading Game?

ASI is an Ethereum-based token that will act as the fuel for the AltSignals ecosystem. Its primary use case will be to access and receive signals from the upcoming ActualizeAI algorithm. This algorithm will boost AltSignals’ accuracy further thanks to a comprehensive AI stack, which includes machine learning, predictive modelling, and sentiment analysis. For ASI holders, they’ll be the first in line to experience the power of this new algorithm.

Holding ASI will also grant exclusive entry into the ActualizeAI Club, where users can play an active role in giving feedback and helping to test the ActualizeAI algorithm in return for early access to the latest upgrades and earning ASI tokens. In the process, they’ll work directly with the AltSignals team to improve their products and optimize the signals produced.

ASI will become the platform’s governance token, allowing users to vote on new upgrades, partnerships, and more. They’ll also be able to set the token’s buyback and burn rate, which will help to restrict the supply of ASI over several years and potentially lead to price appreciation.

The Long-Term Outlook for ASI

The ASI token is predicted to see exceptionally high demand, with many projecting that the ASI presale will sell out rapidly. Traders are expected to flock to the token when they find out it grants access to the ActualizeAI algorithm and Club.

This group alone could easily send ASI skyrocketing as traders rush to become part of an elite group dedicated to building one of the greatest trading algorithms the world has ever seen. This spirit of collaboration and mutual support will set AltSignals apart from other signal providers and is set to be a major contributing factor in the success of the ASI token.

Consequently, several analysts predict that ASI will climb well beyond its final presale price of $0.02274, with some forecasting that $0.50 is easily achievable by the end of 2023. If $0.50 is reached, investors could be up almost 2,100% in just under a year – far beyond what any Bitcoin price prediction could hope to attain.

Should You Invest in ASI?

As Bitcoin’s price continues to grow and the bull market heats up, AltSignals will likely see a massive surge in interest. Thanks to the ActualizeAI algorithm and the platform’s proven reputation, its ASI token will likely be one of the lucky few that return life-changing gains in 2023.

The beta sale price of $0.012 seems exceptionally undervalued, so expect this first phase to sell out quickly. If you’re thinking of getting involved, be sure to visit their presale website.

You can participate in the AltSignals presale here.

Share this article

Categories

Tags

Bitcoin price fell below $20,000 to hit $19,569 on Bitstamp. Source: TradingView

Bitcoin price fell below $20,000 to hit $19,569 on Bitstamp. Source: TradingView