- MicroStrategy says it acquired the additional 5,445 bitcoins for $147.3 million at the average price of $27,053 per coin.

- The company now holds 158,245 bitcoins acquired for a total of $4.68 billion.

MicroStrategy Inc. (NASDAQ: MSTR), a leading finance software company, has added to its Bitcoin (BTC) haul again.

In crypto news shared on Monday by Michael Saylor, the company’s founder and chairman, MicroStrategy recently acquired an additional 5,445 bitcoins to bring its total BTC holdings to over 158k.

MicroStrategy now holds 158,245 bitcoins

According to a filing with the US Securities and Exchanges Commission (SEC), MicroStrategy purchased the BTC for $147.3 million, acquiring each coin at the average price of $27,053. Per the document, the company now holds 158,245 BTC, which was cumulatively acquired for $4.68 billion. The average price of the entire acquisition is $29,582 per bitcoin.

Saylor shared the news on his official X account on Monday.

MicroStrategy has acquired an additional 5,445 BTC for ~$147.3 million at an average price of $27,053 per #bitcoin. As of 9/24/23 @MicroStrategy hodls 158,245 $BTC acquired for ~$4.68 billion at an average price of $29,582 per bitcoin. $MSTR https://t.co/GbJtUoQfXv

— Michael Saylor⚡️ (@saylor) September 25, 2023

Bitcoin price outlook after MicroStrategy news

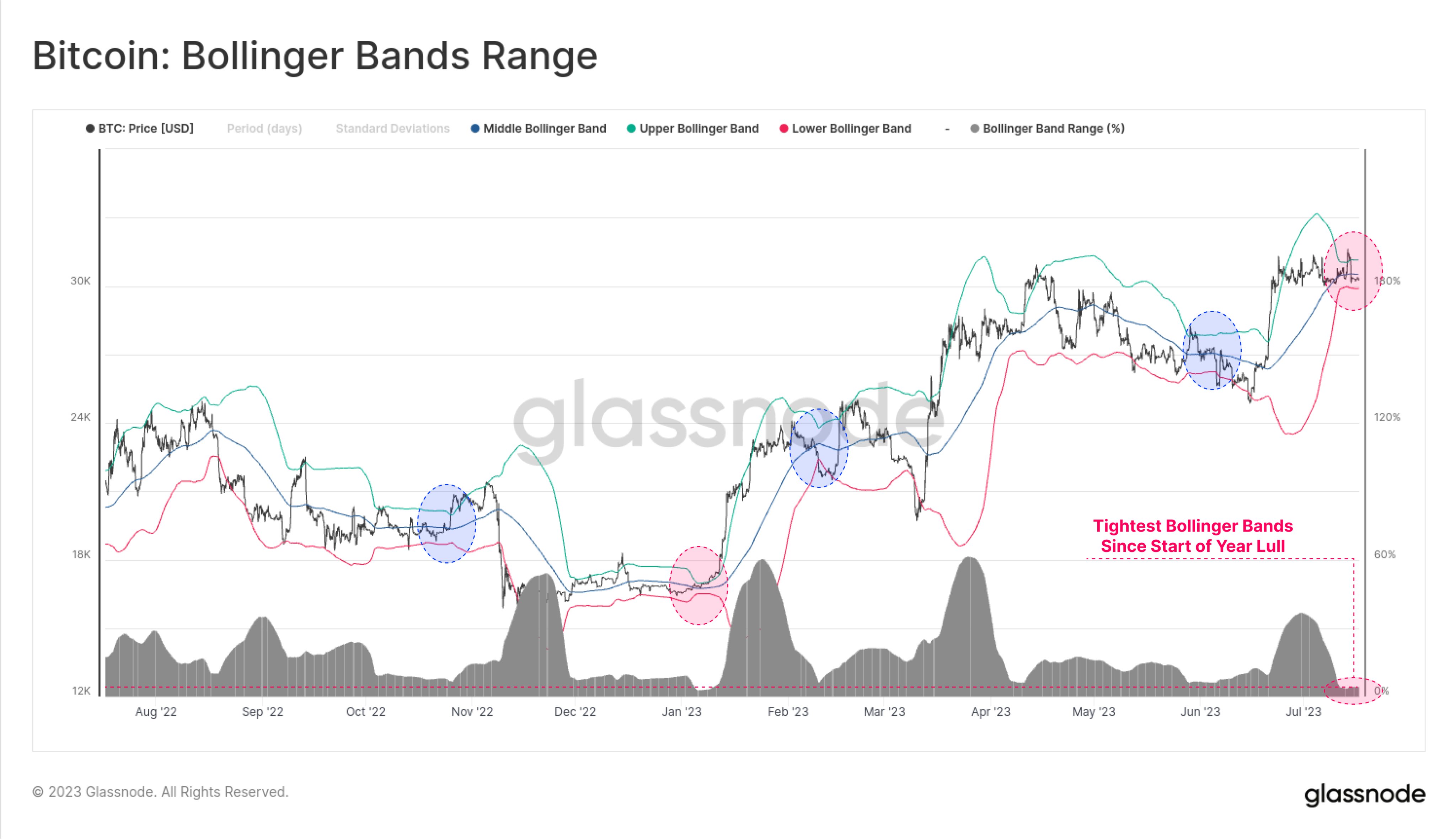

BTC has not moved much over the past few days, with price ranging around the $26k level amid a lack of volatility across the market. On Monday, the benchmark cryptocurrency’s value was hovering around $26,130 on major crypto exchanges, with CoinGecko data showing a -1.8% return in the past 24 hours and 4.6% in the past seven days (as of 09:55 ET).

For MicroStrategy, the declines below $27k (which was the average price for the latest purchase) means the 5,445 coins have seen a depreciation in value at current prices.

As to what happens next for BTC, popular crypto analysts say there’s possibility fresh negativity could send the flagship crypto to support below $25k. A notable anchor below this level would be the psychological $20k zone.

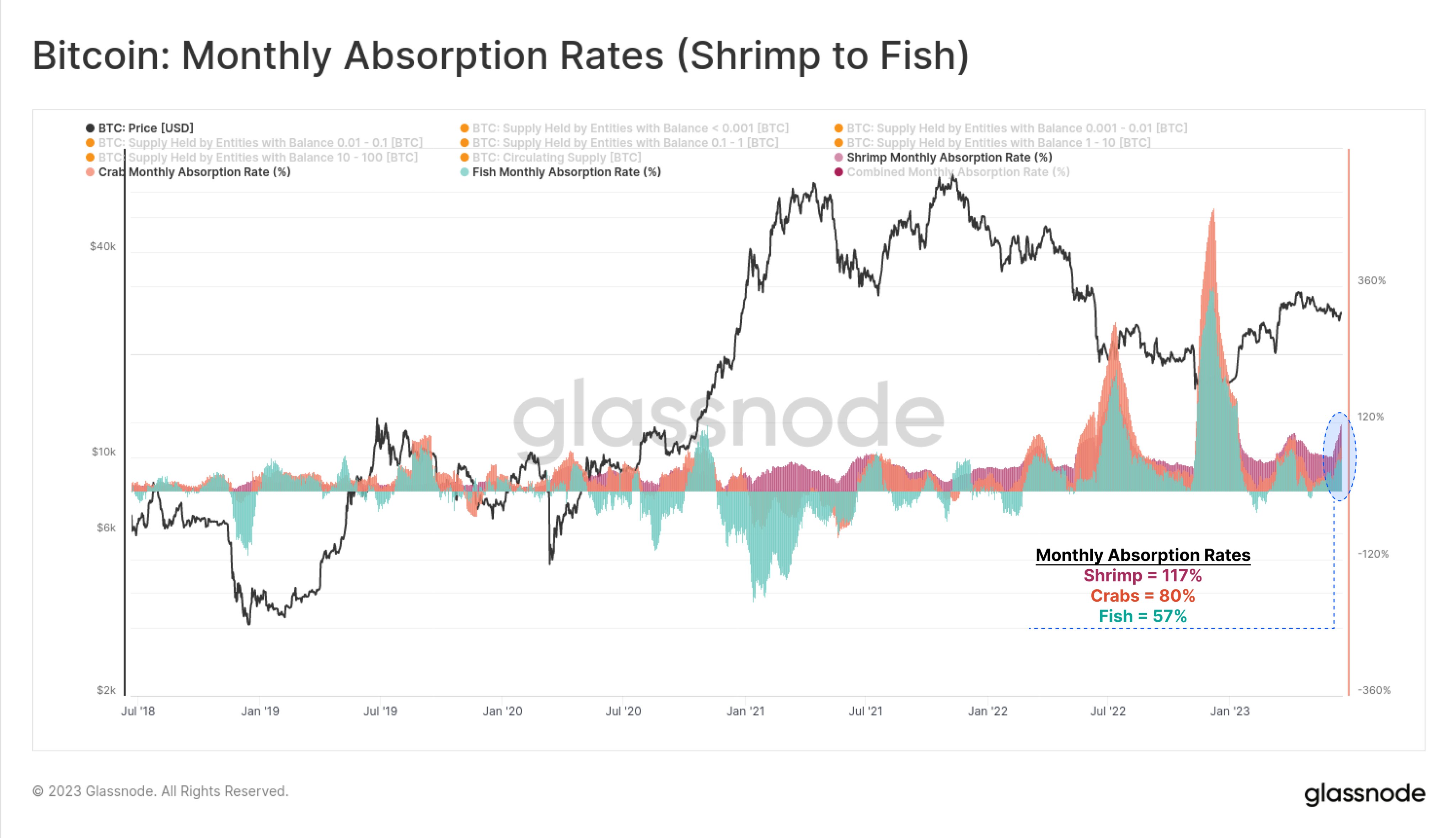

Crypto analyst and trader Joe Burnett says a bullish flip for BTC will take it to a new all-time high. With supply “incredibly dry”, all Bitcoin needs is a “spark of demand.”

BREAKING: NEW ALL TIME HIGH

87.9% of all #Bitcoin has not moved in the last 90 days.

Bear markets end when supply is incredibly dry.

(Any) spark of demand can serve as a catalyst for the next parabolic bull market. pic.twitter.com/2awRgCMWhv

— Joe Burnett (🔑)³ (@IIICapital) September 25, 2023

Among other catalysts, analysts are looking at the upcoming bitcoin halving and the potential for a first spot Bitcoin ETF approval by the SEC. Asset investment giant BlackRock is one of the companies looking to offer access to a spot ETF.