- Bitcoin supply in loss has risen to 68%, with 6.67 million BTC under water water at current spot price.

- Indeed, on-chain data shows 2.71 million BTC has fallen into loss as Bitcoin price dropped from the $31k local top.

- With sell-side risk ratio approaching its all-time lows, Glassnode analyst James Check says BTC could see a big move to either side.

Bitcoin’s price has dropped about 14.6% since rejecting at the local top of $30.9k, and the result has been a sharp rise in the total amount of supply in loss.

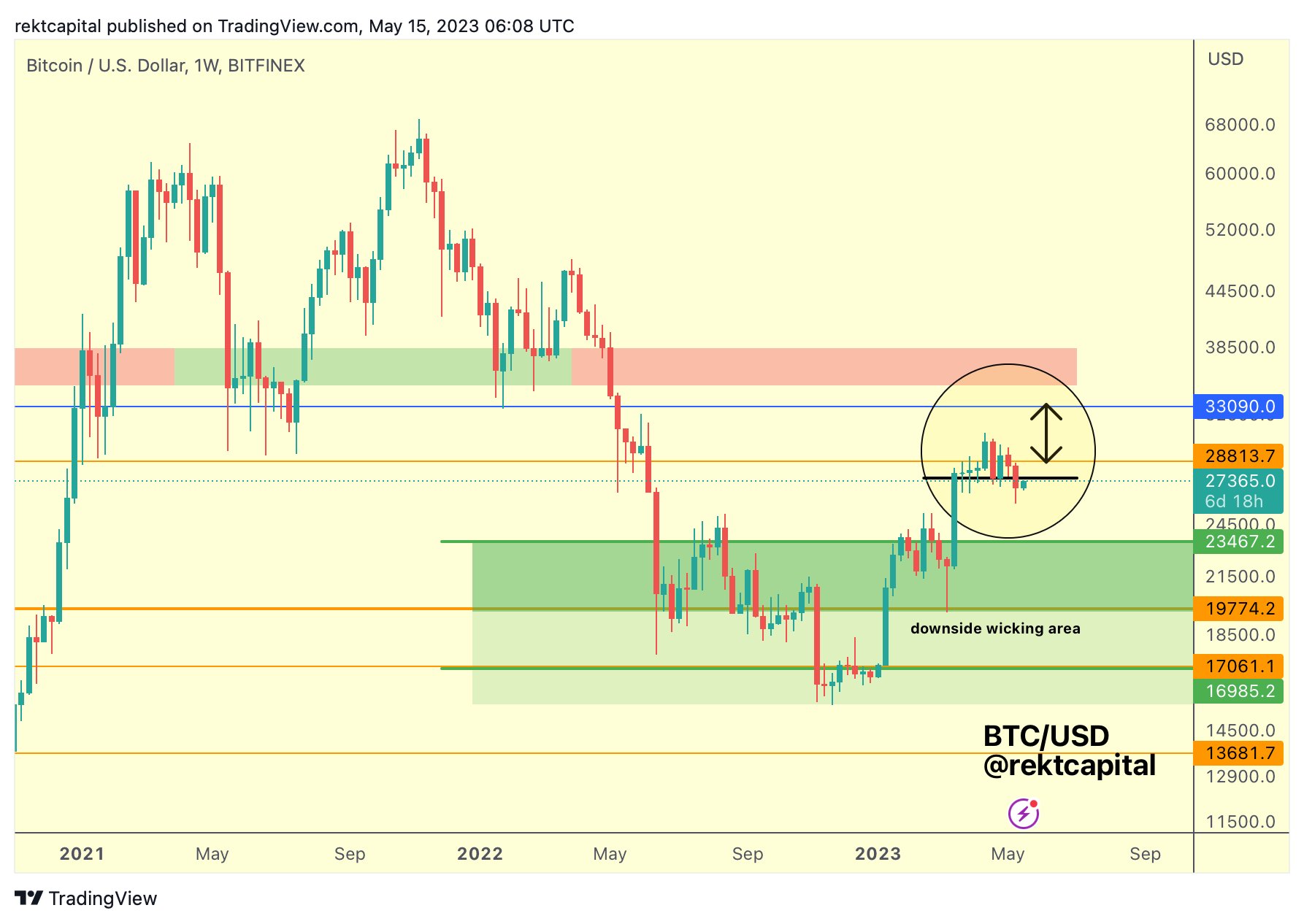

The leading cryptocurrency’s current spot price is around $26.4k, after the week was spent in a tight range below the key resistance level of $27.6k. Although Bitcoin retested levels above $28k multiple times this month, the drawdown below $27k has bulls staring at a potential dip to support at $25k or lower.

But even as this outlook materializes, about 2.71 million BTC has drifted underwater. The BTC supply in loss, according to data shared by on-chain analytics platform Glassnode, is equivalent to about 14% of the benchmark crypto’s circulating supply.

“This raises the total supply in loss across the aforementioned period from 3.96M to 6.67M BTC, a 68.4% increase,” Glassnode noted.

$45k or $20k? Analysts weigh in on BTC price movement

Earlier this week, Glassnode lead analyst James Check said Bitcoin could see a “big move” in coming weeks amid seller exhaustion. Pointing to on-chain-data, Check explained:

“Bitcoin Sell-side Risk ratio is approaching all-time lows. This indicates that investors are reluctant to spend coins which are in profit, or loss within the current price range. This usually occurs when sellers are exhausted on both sides, suggesting big moves are coming.”

On Wednesday, JPMorgan lead strategist Nikolaos Panigirtzoglou said Bitcoin could rise 25% in the next 12 months. In a note to clients, Panigirtzoglou highlighted the price of gold rallying to a new multi-year high above $2k as the potential lead for BTC to hit $45k.

According to the analyst, Bitcoin and gold have often traded in sync. Bitcoin’s upcoming halving will also play a role in ticking up prices of the digital asset. Recently, analysts at Standard Chartered predicted a 70% gain for BTC price, outlining the $100k as a target.