- Bitcoin Dogs (0DOG) is projected to surge as Bitcoin’s price turns bullish.

- 0DOG could reclaim its all-time high of $0.04934 due to increased demand amid new exchange listings.

- Analysts predict a potential 100X move for 0DOG by the end of 2024.

As Bitcoin (BTC) gears up for what could be a record-breaking rally after struggling below $60k, many altcoins within its ecosystem are expected to follow suit, and Bitcoin Dogs (0DOG) stands out among them.

A BRC-20 token, 0DOG is directly tied to Bitcoin’s performance and with the current bullish outlook for BTC and a string of new exchange listings, it is poised to reclaim its previous all-time high of $0.04934.

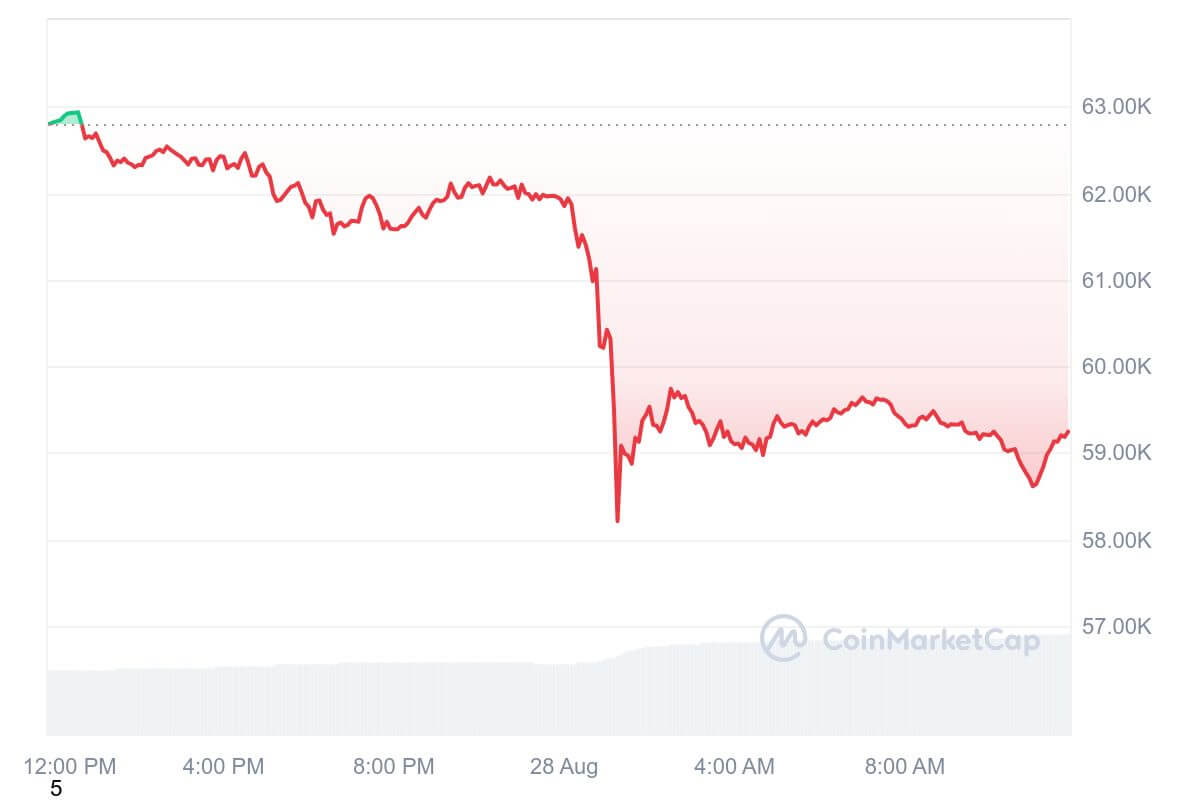

Bitcoin (BTC) regains its footing, surging above $60k

At press time, Bitcoin price stood at $60,022, showing a steady 10% growth in the last seven days.

Although the price remains 17.43% below its all-time high of $72,689 (achieved six months ago), the market sentiment is bullish after a scare that made analysts anticipate a drop below $50k this weekend.

Most technical indicators currently show a buy signal indicating short-term bullishness and a possible long-term bullish trend. The key resistance level to watch is at $60,316, with bottom support around $58,294.

If Bitcoin breaks above the $60,316 resistance, analysts predict it could rapidly surge to the next target of $62,441.

Forecasts suggest Bitcoin could hit $79,207 by the end of 2024, with long-term projections reaching as high as $221,485 by 2025 and $369,701 by 2030. This anticipated growth, driven by institutional adoption and easing credit conditions, sets the stage for the entire Bitcoin ecosystem to surge, including projects like Bitcoin Dogs.

Bitcoin Dogs (0DOG) poised to retest $0.04934

Bitcoin Dogs (0DOG), the first-ever ICO launched on the Bitcoin blockchain as a BRC-20 token, offers a unique opportunity for those looking to capitalize on Bitcoin’s bullish momentum.

0DOG’s value is tied to Bitcoin, meaning as BTC surges, 0DOG is expected to outperform due to its smaller market cap and higher volatility. This is a classic “beta trade,” where a smaller asset experiences more significant percentage gains as its larger counterpart rises.

Currently priced at $0.00986, 0DOG is down 1.4% over the past 24 hours, but analysts are confident that the token is on the verge of a major breakout.

The all-time high for 0DOG is $0.04934, reached on August 22, 2024, and its current price presents a compelling entry point for investors looking to ride Bitcoin’s momentum.

With new exchange listings and a surge in market interest, 0DOG could see significant buy pressure, pushing it back toward its all-time high.

Exchange listings and future projections for 0DOG

Notably, Bitcoin Dogs has been on a listing spree, listing on major exchanges like MEXC, Gate.io, Uniswap, and UniSat Exchange shortly after a successful presale round.

These listings have opened 0DOG to millions of potential investors, increasing liquidity and market exposure.

The MEXC and Gate.io listings, in particular, are significant for the token’s growth prospects. For example, MEXC handles over $2 billion in trading volume daily and has a user base exceeding 6 million, providing Bitcoin Dogs with a massive platform to gain traction.

Also, the MEXC and Gate.io listings caused the token’s price to pump 3X within the first hour of trading, indicating the potential for 0DOG to experience a similar surge amid rumours of additional exchange listings, which could further fuel demand.

This increased market exposure, combined with Bitcoin’s expected bullish trend, makes 0DOG one of the top altcoins to watch in 2024. Analysts are predicting a potential 100X move before the end of the year, driven by both the macro environment surrounding Bitcoin and the internal developments within the Bitcoin Dogs project.

Additionally, a play-to-earn game tied to 0DOG is set to launch later this year, which could attract even more interest and drive up the token’s price.

For more information about Bitcoin Dogs and the 0DOG vesting schedule for those who purchased the token in the recently concluded presale, you can visit the official Bitcoin Dogs website here.