- Bitcoin (BTC) eyes $80K amid institutional FOMO & strong hodling.

- Ethereum (ETH) bullish, targets $4,868 ATH with robust technicals.

- AltSignals (ASI) set a new ATH at of $0.006026.

In the fast-paced world of cryptocurrency trading, accurate price predictions are highly sought after by investors looking to make informed decisions. Today, we delve into the latest price predictions for three prominent cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and AltSignals (ASI).

These predictions are based on a combination of market analysis, technical indicators, and industry trends.

Bitcoin price prediction: eyes on $80,000

Bitcoin, the pioneering cryptocurrency, is experiencing a surge in momentum, recently reaching a new peak of $72,800 on Binance.

Analysts speculate that the price could climb even higher, potentially touching the $80,000 psychological level.

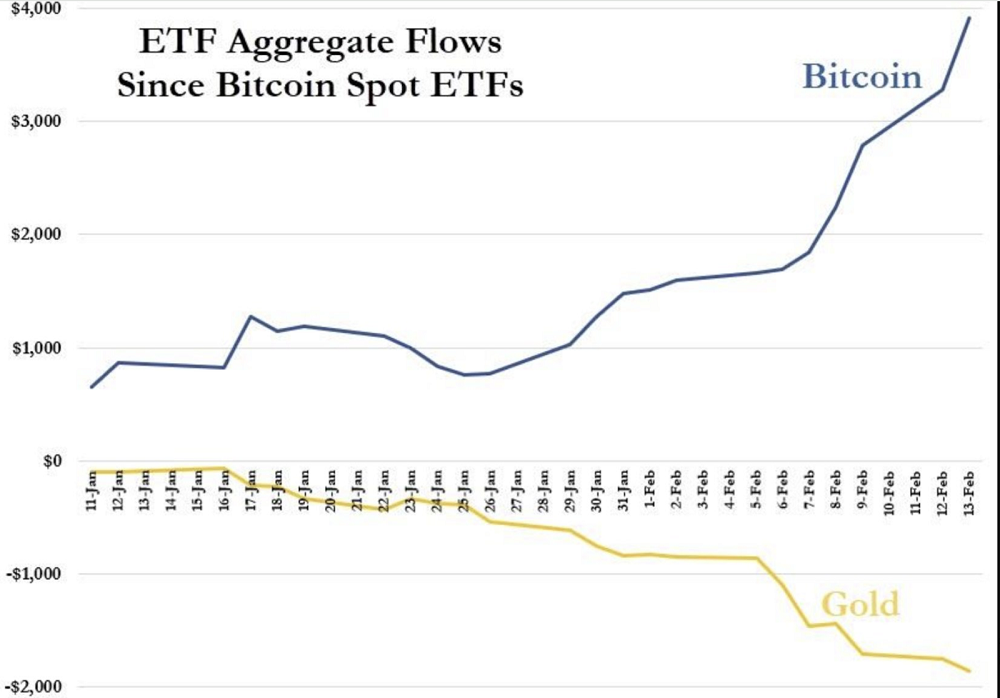

The market is currently witnessing institutional FOMO (fear of missing out), as BTC holders show resilience, refraining from significant sell-offs.

Technical indicators, such as the Relative Strength Index (RSI), continue to show strength despite overbought conditions. This suggests that Bitcoin might extend its upward trajectory.

However, profit-taking could lead to a pullback, with key support levels identified at $69,000 and the supply zone between $62,278 and $65,618.

Ethereum price prediction: expected to reclaim its ATH

Ethereum, not to be outdone, is displaying robust performance, holding above $4,000. With an impressive 85% increase since the start of the year, ETH is poised to reclaim its all-time high of $4,868.

The Awesome Oscillator (AO) and RSI signal strong buyer presence and rising momentum, indicating the potential for a 20% climb.

In case of a pullback, Ethereum may find support around $3,602, providing an opportunity for traders.

AltSignals’ ASI token and ActualizeAI ecosystem

AltSignals is set to revolutionize the trading landscape with ActualizeAI, a groundbreaking upgrade incorporating artificial intelligence, machine learning, and natural language processing.

The AltSignals platform aims to leverage these technologies to provide a fully automated and 24/7 trading capability, improving accuracy and risk management while offering advanced sentiment analysis support.

The ASI token, integral to the AltSignals ecosystem, was recently been listed on Uniswap after a successful presale that raised 1.8 million. At press time, the ASI/USDT trading pair on Uniswap v3 was trading at $0.005964, 52.56% higher than its all-time low price of $0.003913 recorded on March 5, 2024.

Although, rising at a sluggish pace, the ASI token hit an all-time high of $0.006026 on March 11, 2024, and analysts expect it to ride the current bullish market sentiment and AI hype and possibly drop a zero by April.

Beyond trading on Uniswap, ASI holders currently have the opportunity to stake their tokens, earning rewards of up to 25% in the ongoing ASI staking program.

As a deflationary token, ASI comes with a countdown mechanism, providing access to evolving ActualizeAI trading products and contributing to increased token value.

ActualizeAI introduces an AI Members Club, rewarding participants with ASI tokens for contributions to product development, backtesting, feedback, and ideas. It emphasizes community governance, allowing token holders to influence the project’s direction.

What does the future hold for ASI holders?

Looking ahead, AltSignals has outlined a transparent roadmap, ensuring the community’s involvement and maximizing value for token holders. The roadmap spans quarters, with milestones such as token presale launch, AI model development, dashboard design, burn & staking mechanisms, and partnership acquisitions.

ActualizeAI’s roadmap includes the development of a real-time dashboard and notifications powered by a sentiment analysis engine. New AI product releases, a 2-Click onboarding design, and increased global marketing efforts are anticipated in the coming quarters.

AltSignals’ success is underscored by its head start as an established business in 2017.

With a loyal community of 50,000 signal users, this predictive machine learning is poised to revolutionize trading indicators, providing a unified platform for both traditional and cryptocurrency markets.

As AltSignals continues to capture global investor interest, the integration of ActualizeAI promises to disrupt the trading industry, providing traders with cutting-edge tools and technologies for a seamless and empowered trading experience.

Share this article

Categories

Tags