It’s been another busy week in the crypto market: MicroStrategy buys another $4.6 billion of Bitcoin, BlackRock’s Bitcoin ETF options brings in $2 billion on day one, Donald Trump’s transition team considers first White House crypto office, Justin Sun buys a banana for $6.2 million, SEC chair Gensler to step down on January 20, Bitcoin nears $100k as rally continues, and US spot Bitcoin ETFs hit $30 billion in total net flows.

Let’s look at these and recap what happened this week in crypto.

MicroStrategy buys another $4.6 billion of Bitcoin

MicroStrategy is going long on Bitcoin as it adds more of the asset to its already impressive haul.

On November 18, the company announced that it had bought an extra 51,780 BTC. This latest addition pushes MicroStrategy’s total Bitcoin holdings to 331,200. The news follows after the company’s founder, Michael Saylor, announced the purchase of more than $2 billion worth of Bitcoin.

The publicly-listed company, whose stock MSTR has surged amid Bitcoin’s price spike, has acquired $16.5 billion worth of BTC. The average purchase price is $49,874, putting the company billions of dollars in profit as the benchmark cryptocurrency trades near its all-time high.

BlackRock’s Bitcoin ETF options brings in $2 billion on day one

The launch of options contracts on BlackRock’s iShares Bitcoin Trust (IBIT) nearly reached $2 billion on day one of trading.

Taking to X, Bloomberg exchange-traded fund (ETF) analyst James Seyffart, said:

“Final tally of $IBIT’s 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts. That’s a ratio of 4.4:1.”

Bloomberg’s senior ETF analyst Eric Balchunas, said “$1.9b is unheard of for Day One.”

As a result, BlackRock’s options may have helped push Bitcoin to a record of over $94,000.

The launch of BlackRock’s options contracts comes as institutional interest in Bitcoin rises. With the IBIT options, investors can gain exposure to new avenues of investment while managing their risk through the call and put options without owning the underlying asset.

At the end of October, BlackRock’s IBIT reached $30 billion in net assets in 293 days. Two weeks later, it reached $40 billion in net assets in 211 days, showcasing rising interest in crypto investments.

Donald Trump’s transition team considers first White House crypto office

As Donald Trump prepares to enter the White House, reports are underway that his transition team are appointing a senior figure to oversee the growing digital assets industry. By doing so, the figure will oversea regulation at the highest level of government.

While no final decision has been made, Trump’s team has reportedly consulted with several crypto leaders, including Brian Brooks, the former CEO of Binance.US, and Brian Armstrong, the CEO of Coinbase.

Whoever gets the job, industry advocates are pushing for the role to be one with significant access to Trump, By doing so, industry concerns are heard at the highest level of power.

Justin Sun buys a banana for $6.2 million

Justin Sun, the founder of Tron, bought a banana taped to a wall for $6.24 million earlier this week.

Sotheby’s, who hosted the auction, started bidding at $800,000 before jumping into the millions.

Taking to X, Sun, the founder of Tron, said: “I believe this piece will inspire more thought and discussion in the future and will become a part of history. I am honored to be the proud owner of the banana and look forward to it sparking further inspiration and impact for art enthusiasts around the world.”

Before the auction, Sotheby’s estimated it would sell between $1 million and $1.5 million.

SEC chair Gensler to step down on January 20

Gary Gensler, chair of the US Securities and Exchange Commission (SEC), announced that he will step down effective January 20, 2025.

Gensler took over as SEC chair in 2021, following the appointment of Joe Biden as President of the United States. Since filling the role, the SEC has filed several lawsuits against crypto companies, including Binance, Coinbase, Kraken, and Ripple.

His departure from the crypto market will no doubt be seen as a breath of fresh air, given that the SEC – under his leadership – has become known for its regulation-by-enforcement approach toward crypto.

Bitcoin nears $100k as rally continues

On November 22, Bitcoin came within touching distance of hitting $100,000 for the first time, continuing its bull run since the start of November.

According to data from CoinMarketCap, Bitcoin reached $99,500, pushed along by the launch of ETF options earlier in the week. A day previously, Bitcoin topped $98,000.

Joe Constori, head of growth at Theya and institutional lead at the Bitcoin Layer, said on X that Bitcoin at $100,000 is going to happen.

“Its properties have always destined it to be a multi-trillion dollar base layer monetary asset. It just took the price 15 years to catch up,” he added.

At the start of the week, Bitcoin was trading around $93,000.

US spot Bitcoin ETFs hit $30 billion in total net flows

US spot Bitcoin ETFs took in $1 billion in daily total net inflows on Friday as Bitcoin inched closer to $100,000.

BlackRock’s iShares Bitcoin Trust (IBIT) saw the most inflows, attracting $608.41 million, according to SoSoValue data. Fidelity’s FBTC followed with $300.95 million. Bitwise’s Bitcoin ETF brought in $68 million and Ark and 21Shares’ ARKB attracted $17.18 million.

The only ETF to experience negative outflows was Grayscale’s GBTC AT $7.8 million.

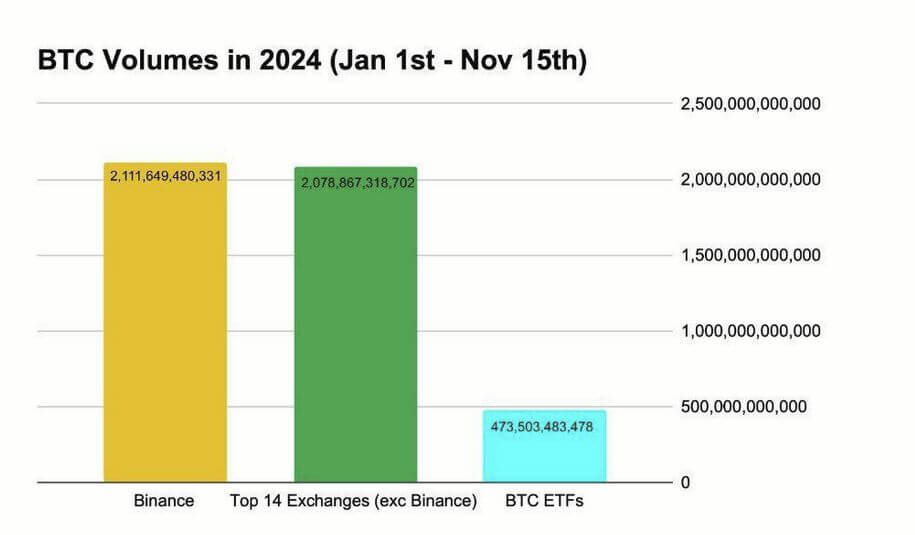

Since launching in January – following approval from the US Securities and Exchange Commission (SEC) – the 12 spot Bitcoin ETFs have earned a combined $30.35 billion.

Share this article

Categories

Tags