Tag: crypto

-

Crypto volatility back to FTX levels, with $791 million of liquidations in 4 days as SVB collapse rocks market

Key Takeaways

- Crypto volatility is back up to levels last seen when FTX collapsed in November

- $791 million of liquidations rocked investors between Thursday and Sunday

- $383 million of longs were liquidated on Thursday and Friday, the largest 48-hour number of the year

- News that deposits will be made whole at SVB propelled the market upwards late on Sunday, with $150 million of short sellers liquidated as Bitcoin retook $22,000

- Despite Fed move stablising prices and 2023 showing a bounceback, the long-term implications for the crypto market are negative here and should concern investors

For once, it’s not crypto doing the collapsing. Trad-fi was feeling left out of the party, evidently, as the banking sector wobbled in a big way this weekend.

Silicon Valley Bank (SVB) is no more, in what amounts to the largest collapse of a US bank since 2008, when Lehman Brothers pulled its best Satoshi Nakamoto impression and disappeared into the ether (pun not intended).

While the drama may have centred in trad-fi, crypto bounced around aggressively over the weekend as a variety of knock-on effects rumbled. SVB was a crypto-friendly bank, as was Silvergate, which was announced to also be winding down last night.

This, as well as the fact that the entire financial markets wobbled, meant crypto faced a storm. We have dug into some of the movements here at https://coinjournal.net/ to sum up the carnage.

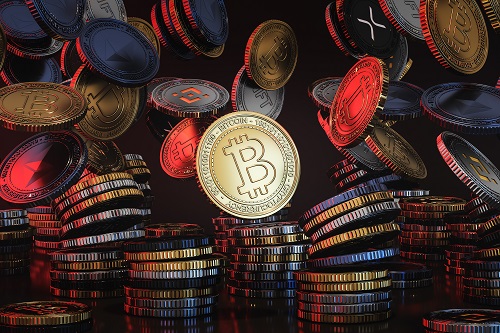

Liquidations

With violent price swings, liquidations were inevitable. Longs got caught out badly on Thursday and Friday, as the Bitcoin price fell south of $20,000.

There were $249 million of long liquidations across exchanges on Thursday, with Friday bringing an additional $134 million. The $383 million of long liquidations was the most in any 48 hour period this year.

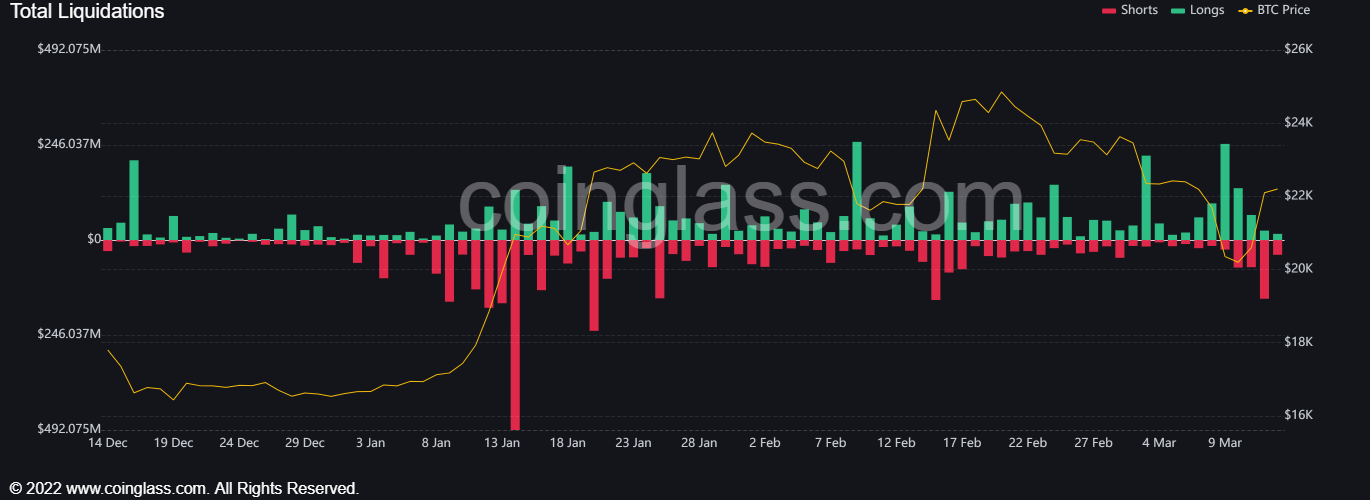

Volatility

Obviously, liquidations stem from volatility. Looking at Bitcoin to dissect the extent of the movements, the volatility is now back up to levels last seen when FTX collapsed in November.

The chart below shows that the metric had been rising steadily, before SVB going poof kicked it back up to a mark 3-Day volatility mark of 50%, last seen when Sam Bankman-Fried’s fun and games were revealed to the public.

“We have been seeing relatively muted action in the crypto markets since the FTX collapse last November” said Max Coupland, Director of CoinJournal. “The SVB event served to kick volatility back up to levels we last saw amid all the crypto scandals of last year – not only FTX, but Celsius, LUNA etc. The difference with this event is that the crash was sparked in trad-fi for a change”.

Crypto bounces back

But all is well that ends well. Or something along those lines, as despite SVB going under, the Fed announced last night, after a weekend of chaos, that all deposits at SVB would be made whole.

The bail-out (if you can call it that, as SVB is still going under) quelled up fear in the markets that the issue could become systemic. Crypto roared back, with Bitcoin spiking back up to $22,000 at time of writing. And this time, it was shorts who got caught offside, with $150 million liquidated across the market Sunday.

Perhaps the biggest winner of all was the world’s second-biggest stablecoin, USDC. 25% of the stablecoin’s reserves are backed by cash. Crucially, 8.25% ($3.3 billion) of reserves were (are) trapped in SVB, with the stablecoin dipping below 90 cents on several major exchanges over the weekend.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

At press time, the peg has been largely restored as the crypto market bounces upward, with Bitcoin north of $24,000.

What next for crypto?

And so, the immediate storm appears to have been weathered in cryptoland.

Nonetheless, the past few days present as yet another crushing blow. Three of the big crypto banks – SVB, Silvergate and Signature – are now no more. These banks allowed crypto firms to offer on-ramping from fiat into crypto 24/7 through their settlement services, in contrast to the regular banking hours of the banking sector.

Liquidity and volume thus may dip even further in the crypto market, after a year that has already seen volumes, prices and interest in the space freefall.

Despite the Fed stepping in to shore up deposits and hence stabilising the stablecoin market and wider crypto prices, the long-term future of the cryptocurrency industry in the US has taken another heavy body blow this weekend. And with the US being the biggest financial market in the world, that is very bad news.

Coupled with the regulatory clampdown by the SEC in the last few months, 2023 has followed 2022 in creating a more hostile and bearish environment for the sector at large.

So crypto investors may have seen a bounceback in prices in the last few months, but this appears to be largely macro-driven correlation with the stock market, as the underlying events in the industry – regulation, more bankruptcies, and crypto-friendly banks shuttering – have not been positive.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.

-

Bitcoin price breaks below $20K amid crypto selloff

- Bitcoin price fell below $20,000 for the first time since November 2022.

- The top crypto asset by market cap dumped amid broader selloff for cryptocurrencies, largely fueled by negative news.

- Among other news, the New York Attorney General has sued KuCoin over offering of unregistered securities, with Ethereum named as one of the securities.

Bitcoin price has dropped nearly 10% in the past 24 hours amid negative cryptocurrency news that could yet catalyse further losses.

As the Bitcoin price chart below shows, the value of the leading cryptocurrency by market fell to lows of $19,569 on cryptocurrency exchange Bitstamp.

Bitcoin price fell below $20,000 to hit $19,569 on Bitstamp. Source: TradingView

Bitcoin price fell below $20,000 to hit $19,569 on Bitstamp. Source: TradingViewThis after a selloff that began late Thursday extended into Friday morning, with the dump pushing BTC below the psychological support zone of $20,000 for the first time since November 2022 during the FTX dump.

Why Bitcoin and crypto crashed today

As CoinJournal reported early Friday, today’s selling pressure for cryptocurrencies comes after the New York Attorney General sued the crypto exchange Kucoin alleging it sold unregistered securities. The negative news was compounded by the fact that the lawsuit identified Ethereum as one of the securities.

The market’s reaction saw Ethereum price plunge to lows of $1,375 and was down 9.8% at the time of writing.

Overall selloff pressure also follows news that crypto bank Silvergate was winding down. The company’s shares plummeted nearly 50% in the aftermath, with fears of even more damage amid a Silicon Valley “bank run.”

Another headline news likely to have fueled fresh downside for crypto was reports that the US was targeting a new tax on Bitcoin mining. Huobi Token’s flash crash and a security breach on Hedera also added to the broader market bloodbath.

Crypto analyst Miles Deutscher highlighted this confluence of negative triggers, noting that stocks and cryptocurrencies have shed over $2 trillion in market cap over the past 24 hours.

In the last 24 hours:

• Stocks + crypto shed $2T in value

• New York Attorney labels $ETH a security

• KuCoin hit with lawsuit

• Silicon Valley bank crash

• Huobi flash crash

• Biden proposes tax on $BTC mining

• Voyager liquidating assetsJust another day in crypto..

— Miles Deutscher (@milesdeutscher) March 10, 2023

-

Bullish Bitcoin Price Indicates Crypto Market Recovery

With Bitcoin’s price making a resurgence, investors are gearing up for a bull market in 2023. Crypto signal providers are seeing renewed interest thanks to their ability to save investors time and money by pinpointing the best entries. Many savvy traders continue to recommend AltSignals as the go-to platform.

Thanks to its sterling reputation, AltSignals’ recently announced ASI token presale is expected to be huge. In this article, you’ll find out why AltSignals is so highly regarded and why its ASI token could elevate the online trading experience for investors all across the globe.

Bitcoin Price Revitalized, Prompting Investors To Check Out AltSignals

It seems like a risk-on mood is back in the markets. With the Fed expected to slow down or reverse interest rate hikes this year, investors have been loading up on crypto before the next bull cycle begins.

Since the start of 2023, Bitcoin’s price has risen almost 47% from around $16,500 to a high of approximately $24,250 in early February. This rapid ascension in Bitcoin’s price has accompanied a surge in interest in online trading, leading many investors to start looking for the best crypto signal providers to boost their profits. One name that has regularly cropped up is AltSignals.

What Is AltSignals?

AltSignals is a leading name in the crypto signals industry, established in 2017. It uses a team of market experts and professional traders to combine technical and fundamental analysis with its in-house algorithm, AltAlgo™. As a result, AltSignals has earned a reputation as one of the most reliable and profitable signal providers out there.

This reputation is quickly validated when looking over their stats. Over 52,000 traders rely on the 3,700 trade calls it has produced since its launch, with the platform holding a 4.9/5 rating on Trustpilot after receiving nearly 500 positive reviews. The actual trading results speak for themselves: AltSignals has returned over 10,000% in 19 out of 32 months on record.

AltSignals’ ASI token is projected to attract a new wave of attention to the AltSignals platform. This is due to the excellent benefits ASI will offer holders that will help them make the most out of their online trading journey.

How Is ASI Expected To Change the Online Trading Game?

ASI is an Ethereum-based token that will act as the fuel for the AltSignals ecosystem. Its primary use case will be to access and receive signals from the upcoming ActualizeAI algorithm. This algorithm will boost AltSignals’ accuracy further thanks to a comprehensive AI stack, which includes machine learning, predictive modelling, and sentiment analysis. For ASI holders, they’ll be the first in line to experience the power of this new algorithm.

Holding ASI will also grant exclusive entry into the ActualizeAI Club, where users can play an active role in giving feedback and helping to test the ActualizeAI algorithm in return for early access to the latest upgrades and earning ASI tokens. In the process, they’ll work directly with the AltSignals team to improve their products and optimize the signals produced.

ASI will become the platform’s governance token, allowing users to vote on new upgrades, partnerships, and more. They’ll also be able to set the token’s buyback and burn rate, which will help to restrict the supply of ASI over several years and potentially lead to price appreciation.

The Long-Term Outlook for ASI

The ASI token is predicted to see exceptionally high demand, with many projecting that the ASI presale will sell out rapidly. Traders are expected to flock to the token when they find out it grants access to the ActualizeAI algorithm and Club.

This group alone could easily send ASI skyrocketing as traders rush to become part of an elite group dedicated to building one of the greatest trading algorithms the world has ever seen. This spirit of collaboration and mutual support will set AltSignals apart from other signal providers and is set to be a major contributing factor in the success of the ASI token.

Consequently, several analysts predict that ASI will climb well beyond its final presale price of $0.02274, with some forecasting that $0.50 is easily achievable by the end of 2023. If $0.50 is reached, investors could be up almost 2,100% in just under a year – far beyond what any Bitcoin price prediction could hope to attain.

Should You Invest in ASI?

As Bitcoin’s price continues to grow and the bull market heats up, AltSignals will likely see a massive surge in interest. Thanks to the ActualizeAI algorithm and the platform’s proven reputation, its ASI token will likely be one of the lucky few that return life-changing gains in 2023.

The beta sale price of $0.012 seems exceptionally undervalued, so expect this first phase to sell out quickly. If you’re thinking of getting involved, be sure to visit their presale website.

You can participate in the AltSignals presale here.

-

Crypto VC exec on bulls’ case

- Chris Burniske says Ethereum could outperform Bitcoin in March due to the Shanghai upgrade.

- Burniske is a partner at crypto-focused VC Placeholder and formerly of ARK Invest (crypto division).

- According to the investor, pullbacks are likely to remain “within current uptrend.”

Chris Burniske, partner at venture capital firm Placeholder and former head of crypto ARK Invest, is bullish on crypto going into March.

The investor believes the recent flip in sentiment has not resulted in deeper rot for major cryptocurrencies, despite the weakness seen across stocks amid investor anxiety over interest rates.

In a tweet posted this weekend, Burniske said the outlook is mostly bullish as recent pullbacks have been largely mild.

“From where I sit, I’m surprised crypto hasn’t pulled back more given weakness in equities and upward repricing in rates — bullish,” he noted.

Ex-ARK Invest head of crypto shares Ethereum and Bitcoin price predictions

Bitcoin and Ethereum have both retreated from year-to-date highs, from above $25k and $1.7k respectively.

As noted above, the leading digital assets by market capitalization have given up the recent gains amid continued jitters over US inflation data. Buy-side volume has also tanked on shifting sentiment around the regulatory environment in the United States returned sell-off pressure across the markets.

But while Bitcoin has retraced to support around $23,000 and Ethereum continues to hover around $1,600, the crypto bull says any further losses in the short term are likely to be “within the current uptrend.”

“To those saying some version of “just wait,” sure we could pull back a bit more, but calls for new lows anytime soon are silly. Pullbacks are consolidation within the current uptrend, imo,” the investor added.

In terms of price prediction for the top two coins, Burniske thinks Ethereum will outperform Bitcoin in March. According to him, ETH is likely to gain fresh momentum from the highly anticipated Shanghai upgrade, which is expected to drive staking flows.

A guess:

-January $BTC beasted, led the rest

-February we mostly consolidated

-March $ETH beasts, leads the rest with Shanghai upgrade driving ETH staking flows— Chris Burniske (@cburniske) February 24, 2023

The outlook is supported by on-chain data, which shows new value sent to the ETH 2.0 deposit contract continues to rise.

Crypto analytics firm Santiment recently shared a chart showing that the number of newly staked coins rose a 5-month high count earlier this week.

📈 #Ethereum $ETH New Value Added to the ETH 2.0 Deposit Contract just reached a 5-month high of $69,991,765.78

Previous 5-month high of $62,631,647.91 was observed on 23 January 2023

View metric:https://t.co/0FBplusJVM pic.twitter.com/eKJuqYojRG

— glassnode alerts (@glassnodealerts) February 25, 2023