Key Takeaways

- The cryptocurrency market cap is back above $1 trillion following the biggest surge in 9 months

- Half a billion dollars of short sales were liquidated over the weekend, the most in three months

- Bitcoin is back above $21,000, Ethereum above $1,500, while altcoins have soared

- Despite powerful bounce, the market is still down close to 65%, having peaked at nearly $3 trillion in November 2021

- Bear market drawdown at 77% for Bitcoin, but traders are wary this may only be a short-term relief rally

For a few hours over the weekend, if you looked at a crypto chart, it felt like it was 2020 again.

COVID may be fading into the rear-view mirror, but so had crypto prices. I produced a deep dive into some on-chain data last week which showed how torrid 2022 had been for investors, with 73% less bitcoin millionaires, a drawdown of $2 trillion in the overall crypto market, and a reputation dragged through the mud by various scandals.

Looking at data this week for coinjournal.net, it is a little more optimistic for crypto investors.

Half a billion dollars of short sellers liquidated

The weekend brought a little respite, however. Bitcoin surged to its strongest rally in 9 months, taking the market by surprise and breaking upwards above $21,000.

Looking at data from Coinglass, there were over half a billion dollars of short sellers liquidated this past weekend. The below chart shows the extent of these liquidations, more or less matching the long liquidations back when FTX collapsed in early November.

Crypto market regains $1 trillion mark

The bounce in digital assets followed softer-than-expected inflation data. This optimism that inflation may have peaked has caused investors to bet that the Federal Reserve may pivot off its high-interest rate policy sooner than previously expected.

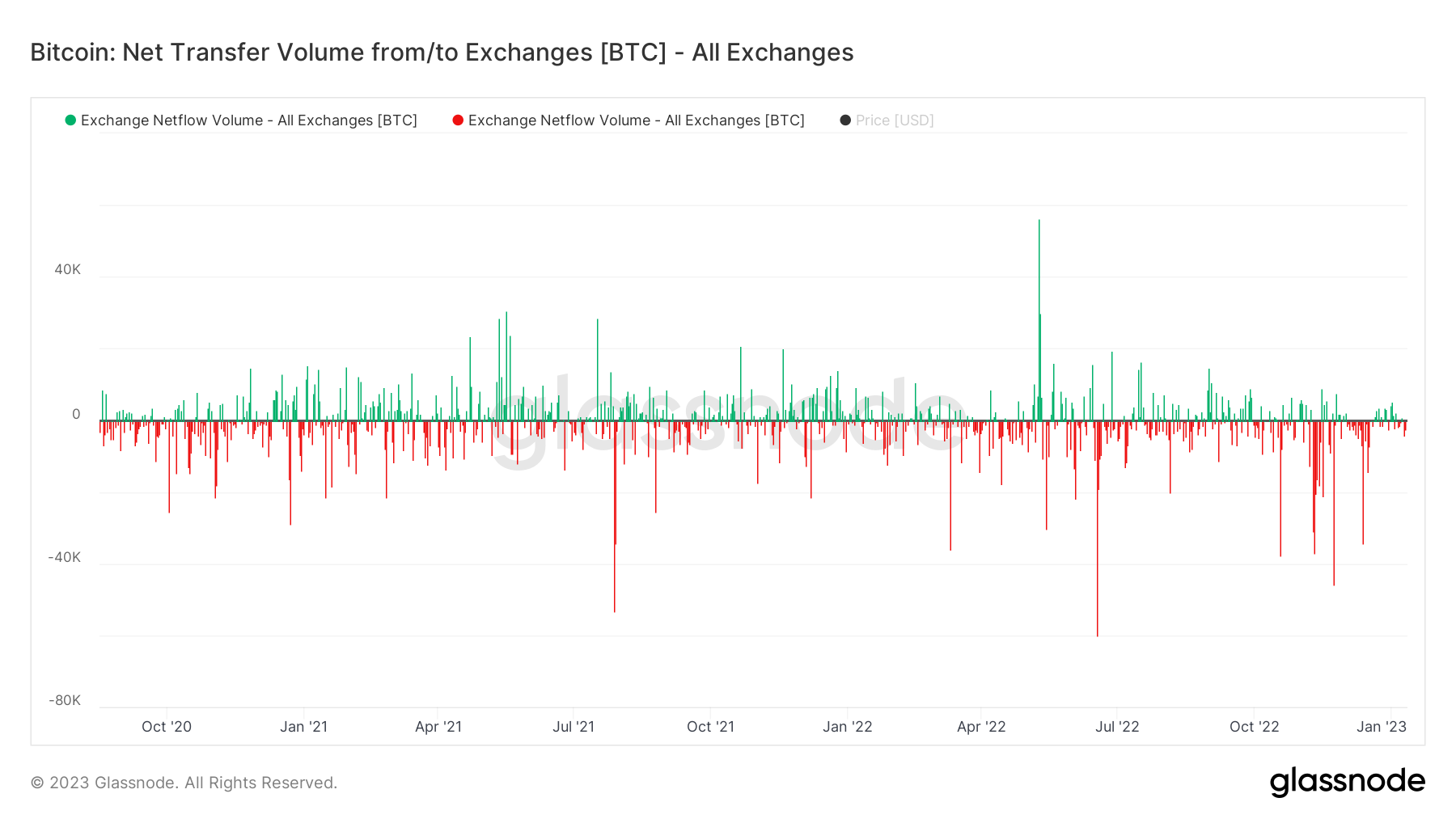

As we know by now, high-interest rates have sucked the liquidity from the market, hurting risk assets across the board. Crypto is very much trading like one of these high-risk assets, and hence prices have collapsed as the Federal Reserve has implemented this tight monetary policy – and hence crypto exchanges have been less than kind to long traders.

2023 has brought hope that if inflation truly has peaked, a light at the end of the tunnel may be visible. The crypto market has surged to regain a $1 trillion dollar market cap as a result. It is still a far cry from the near-$3 trillion all-time high, but Bitcoin at $21,000 and Ether at $1,500 marks the highest prices for the duo since before the FTX scandal.

Has the crypto market bottomed?

The glaring question facing investors now is whether this is merely a short-term relief rally, or whether the bottom is in.

As with most questions in the market, macro holds the key.

“The last couple of months have undoubtedly brought indicators of a more positive environment with regards to inflation, as well as the boost of the Chinese economy reopening,” said Max Coupland, Director at CoinJournal.

“However, I do worry whether investors are jumping the gun by presuming that this means the Fed will now pivot sooner than expected. (Fed chair) Jerome Powell has been adamant that rates will not taper until inflation is firmly under control, and we are still a long way from the 2% target, while uncertainties such as the Russian war in Ukraine still loom as highly unpredictable”.

Let’s play the (very) hypothetical game of assuming the bottom is in. That would put the bear market at 13 months long, with a 77% drawdown from peak-to-trough for Bitcoin.

Historically, this would place it as the third biggest drawback in history. However, that would only be in percentage terms. The crypto market today is vastly different to years past, and the size of the capital wipeout is on a different level – or over $2 trillion, to be precise.

So, while the length and size of the bear market could perhaps imply we are in the latter stages, past data simply cannot be reliably extrapolated when it comes to crypto. Bitcoin only broke through as a mainstream asset in the last few years, and prior time periods featured low liquidity and a niche set of investors.

Today, we are also facing an unprecedented macro climate – rampant inflation, high interest rates for the first time in Bitcoin’s history, and a bear market in the wider economy for the first time since the 2008 crash – the same year Bitcoin was invented.

In wrapping up, the past weekend has been a welcome reprieve for crypto investors, and amounts to the most powerful surge in nine months, back before the collapses of LUNA, Celsius, FTX and the transition to high interest rates in the board economy.

But the road ahead remains tough for the market at large, with inflation still lofty, a war ongoing in Europe and myriad other macro variables oscillating. This week has been good news, but crypto investors won’t be counting their chickens quite yet.

The next mark on the calendar? The all-important FOMC meeting on February 1st, when the Federal Reserve will decide upon the latest interest policy.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.

Research Methodology

Liquidation data via Coinglass. Price data from Yahoo Finance. All other data via CoinJournal