- Cryptocurrencies including Bitcoin, Ethereum, BNB, Solana, and XRP traded higher and then pared gains.

- Sentiment improved with the release of the US Consumer Price Index (CPI) report, but prices failed to rally.

- Analysts say the CPI data makes a Federal Reserve rate cut on October 29 “highly probable”.

Major cryptocurrencies including Bitcoin, Ethereum, BNB, Solana, and XRP have maintained steady prices despite Wall Street’s robust reaction to a key economic data release.

As such, the cryptocurrency market was largely muted on Friday October 24, 2025, with an initial price spike following the release of the US Consumer Price Index (CPI) report failing to flip into notable gains.

While several coins traded in the green, the subdued action meant the global crypto market capitalization, per CoinGecko, remained at $3.81 trillion.

Sentiment was still largely negative as the Fear & Greed index hovered at 32 and was in fear territory.

Meanwhile, global daily trading volume slipped to $153 billion.

Bitcoin, Ethereum prices as investors react to CPI data

The Bureau of Labor Statistics released the US CPI inflation report for September on Friday.

Data showed inflation was cooler than expected, with headline CPI at 0.3% and core inflation at 0.2%.

Meanwhile, both year-over-year measures for headline and core came in at 3%.

Economist Mohamed El-Erian commented on what the data says:

“This report makes a Federal Reserve rate cut next week highly probable. What happens beyond that, however, will depend on subsequent data, primarily confirmation of a softening labor market and continued disinflation.”

Stocks however, soared amid the report and a host of other bullish factors.

Bitcoin traded to highs of $111,842 before quickly retreating to $110,500.

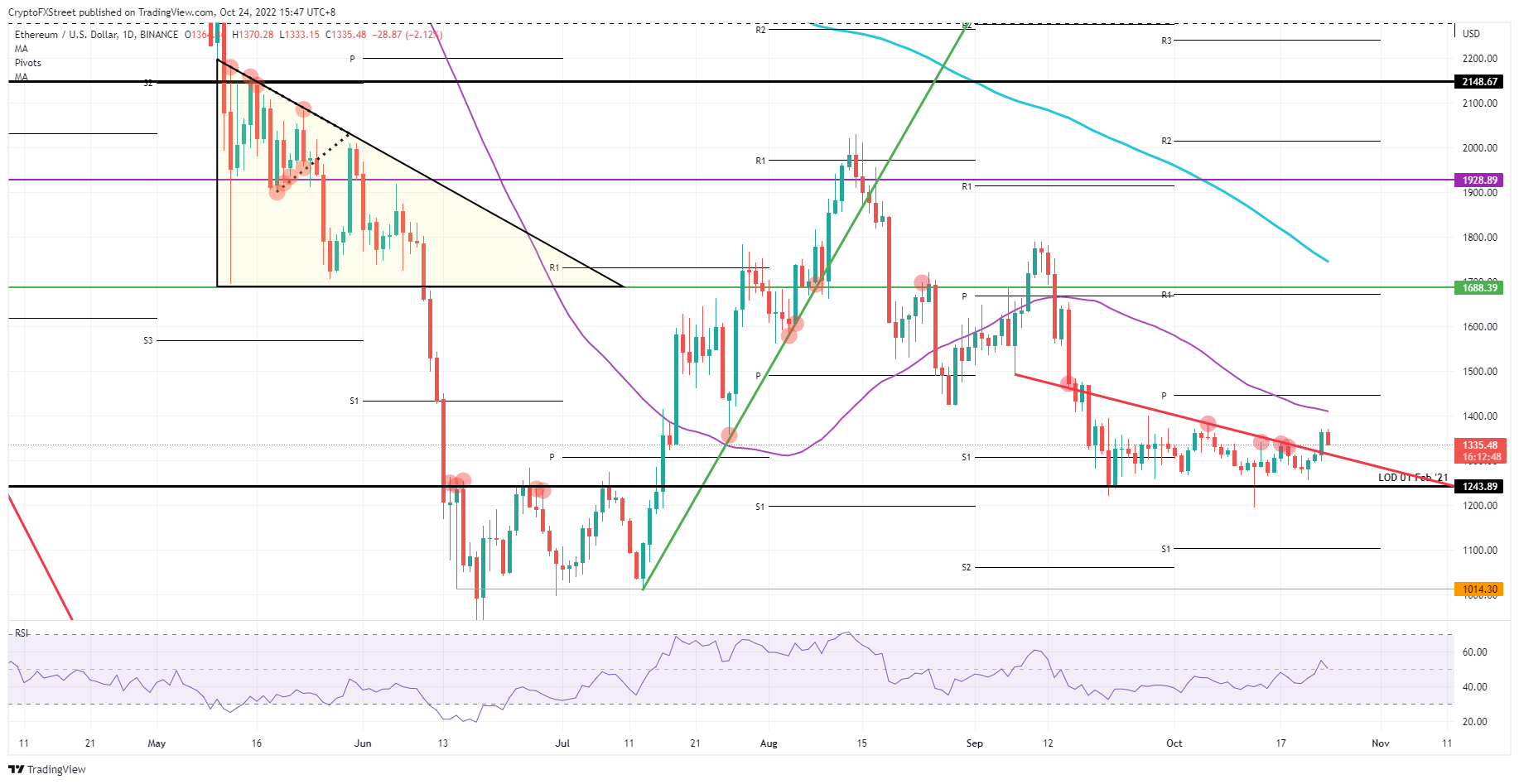

Ethereum on the other hand, rose slightly to near $4,000 before revisiting $3,870 and settling just above $3,900.

Despite the cooling inflation data, analysts see a 99% likelihood of a Federal Reserve rate cut on October 29.

This will feed into risk asset appeal and both BTC and ETH could rally past key supply walls around $115k and $4,250.

BNB steady after Changpeng Zhao pardon

BNB, the native token of Binance, has maintained its price at $1,106, with negligible movement post-CPI.

The token is benefiting from Binance’s dominance in spot trading, and the news of President Donald Trump’s pardon of founder Changpeng Zhao buoyed the broader market.

Congratulations to my friend @cz_binance. Trump has corrected a grave injustice. The weaponization of the justice department against our industry and its entrepreneurs should have never happened. It was and still is a deep wound that will take a long time to heal https://t.co/OirXN3fSZC

— Charles Hoskinson (@IOHK_Charles) October 23, 2025

BNB price moved from lows of $1,048 to near $1,150 on October 24 before settling near the psychological $1,000 mark.

Solana and XRP steady but below key levels

Both Solana and XRP held steady at $190 and $2.49, respectively.

Network activity, partnerships and acquisitions have complemented sentiment built around spot ETF anticipation and treasury strategy moves.

However, SOL and XRP are below the key buy zones of $200 and $3.00, respectively.

Confidence could skyrocket if bulls take out bears at these levels.

News that Ripple is one of the crypto titans bankrolling donations for Trump’s White House ballroom project see XRP get further limelight.

-638023371670565673.png)