Over the last few months, the crypto market has largely been pretty serene. Bitcoin had been in crab motion around $20,000 for quite a while, as it plodded along while waiting for the wider macro conditions to make a move.

I wrote in late October to be cautious around this price action, and that Bitcoin could be one bearish event away from an aggressive downward wick. What I did not except was that event to be shake crypto to its bones, as one of the blue-chip companies in the space, FTX, inexplicably descended into insolvency.

This obviously shook markets. Last week I assessed how the flow of bitcoins out of exchanges has been fierce, as people’s trust in these central entities to store their coins was understandably at an all-time low.

In fact, I saw yesterday that 200,000 bitcoins have left exchanges since the FTX implosion. But now, the data suggests that the market is calming down a bit. And again, it seems like we may enter crab mode until macro provides an impetus one way or another – or an unexpected crypto-specific development comes out of the woodwork.

The first way to demonstrate that the dust is beginning to settle is by looking at Bitcoin’s volatility. This obviously spiked as Sam Bankman-Fried’s “games” were revealed to the public. But after remaining elevated throughout the last few weeks, it has fallen back down to more standard levels in the last few days.

Another way to view this is the falloff in large transactions. These transactions (defined as greater than $100,000) jumped up in the few days around the bankruptcy, but have fallen gradually since, back to the same levels we have seen throughout much of 2022.

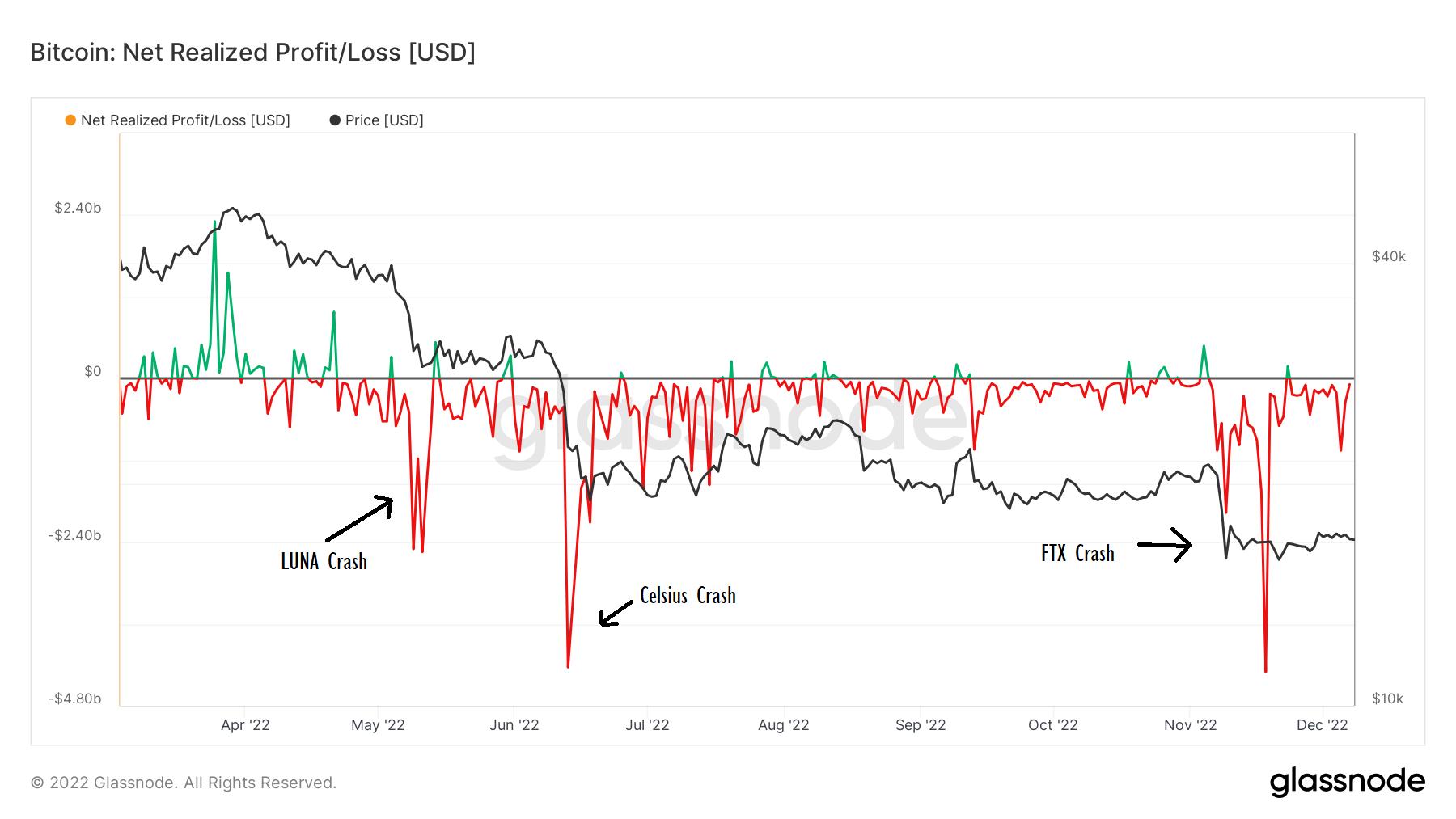

Another useful metric to track is the net realised profit or loss of moved coins. This spikes in times of crisis as the price abruptly drops, before typically coming back towards the $0 mark as the markets calm down.

The below chart shows this well, with trades on November 9th netting an ugly $2 billion loss, before November 18th then topped this with a $4.3 billion loss. That is lower than the worst mark post-Celsius crash ($4.2 billion loss) and Luna ($2.5 billion loss).

This reflects the continued downward pressure on Bitcoin’s price, but the trend has bounced back up to close to zero again.

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion is not over.

FTX was a central part of the ecosystem, and its bankruptcy understandably rocked the market. As I wrote recently, this contagion is not over.

Yet data from the last week or so suggests that normalcy is returning to the crypto markets. Going forward, it may tread water again for a while. With China opening up post-lockdown, the latest inflation numbers imminent and the EU ban on Russian crude imports, macro certainly has a lot going on.

Crypto investors will just need to hope that the crypto-native scandals are out of the way for the time being.

Leave a Reply