- BTC price is near the $30k mark, which bulls may be desperate to protect.

- Bitcoin’s historical volatility is at its lowest level in 2023.

- Short-term bullish target could be above $34k, while major support is near $28.2k.

Bitcoin’s price remains above $30,000 on Monday, but is seeing “remarkably little volatility.” According to a key technical analysis indicator for this measure, the prices are tightly squeezed to suggest a breakout in either direction could be big.

Bitcoin price outlook: Bollinger Bands

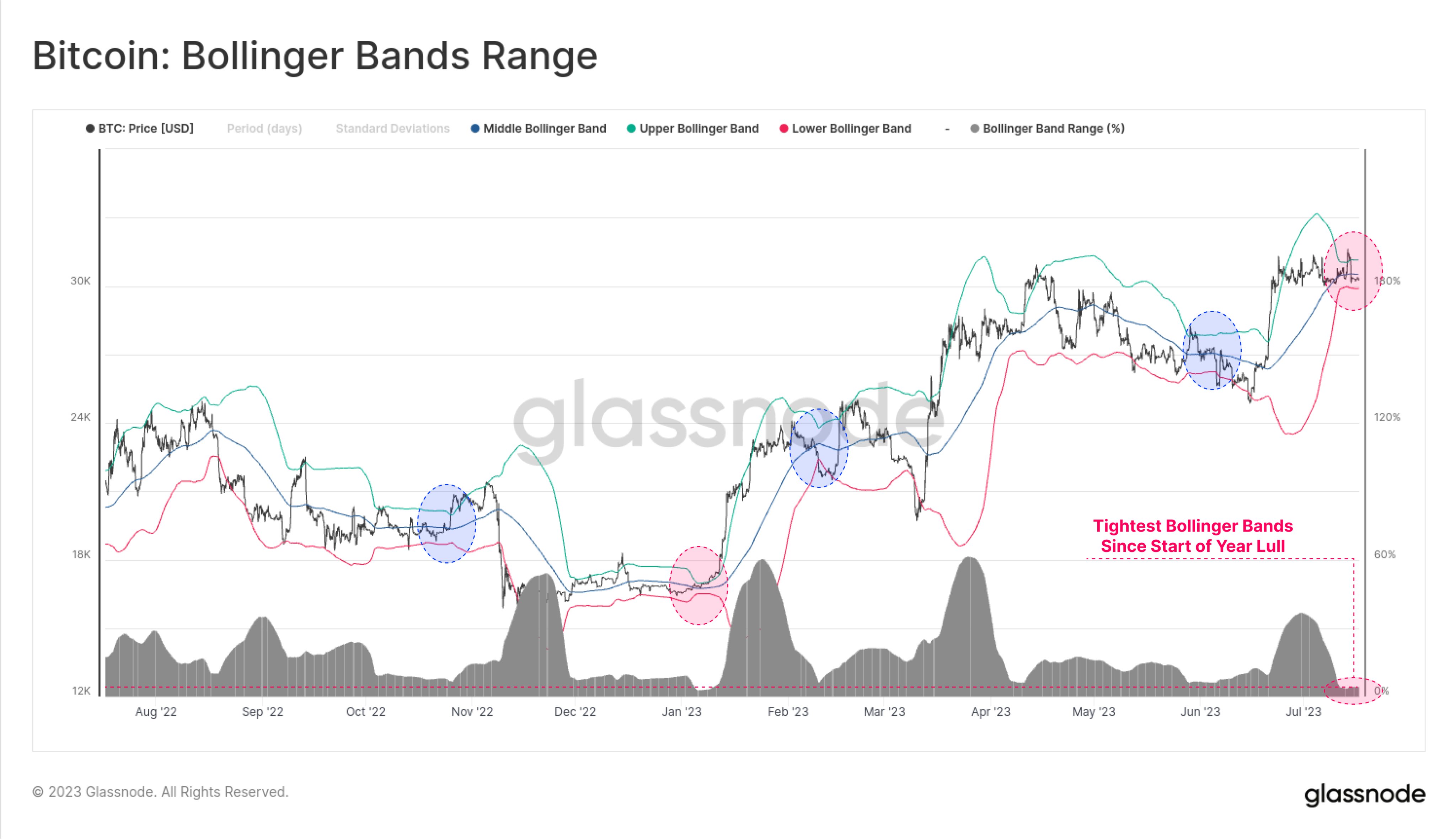

According to on-chain data and analytics provider Glassnode, the Bollinger Bands are tightly squeezed and a price range of only 4.2% separates the upper and lower bands. The platform notes that this outlook has Bitcoin at its quietest since early January.

“The digital asset market continues to see remarkably little volatility, with the classic 20-day Bollinger Bands experiencing an extreme squeeze. A price range of just 4.2% separates the upper and lower Bollinger bands, making this is the quietest #Bitcoin market since the lull in early January,” Glassnode analysts tweeted, sharing the chart below.

Bitcoin price Bollinger Bands range. Source: Glassnode on Twitter.

Bitcoin price Bollinger Bands range. Source: Glassnode on Twitter.

In technical analysis, the Bollinger indicator offers a chart outlook where price trends reflect the market’s volatility. Traders use the indicator to identify overbought or oversold market conditions.

Bitcoin recently broke from above the upper bands and currently fluctuates beneath the middle trendline. Support of the lower Bollinger bands is around the crucial $30k level.

Data shows BTC price has declined from highs of $30,400 late Sunday, touching intraday lows of $30.079 on Monday morning. Currently at around $30,180, the top cryptocurrency by market cap is down about 0.5%.

While accumulation around the current prices is staggering, bulls have to hold above this psychological support base. If not, bears could push lower first before a likely short squeeze catapults BTC/USD to potentially news YTD highs of $34k. The key downturn levels to watch in the short term are at $28,200 and $25,600.

Leave a Reply