TL;DR

The cryptocurrency market has been bullish today, with prices of most cryptocurrencies up by more than 2%. With the market in a bullish state in the last few days, Shiba Memu is also closing in on a new record as its presale now stands above $2.9 million.

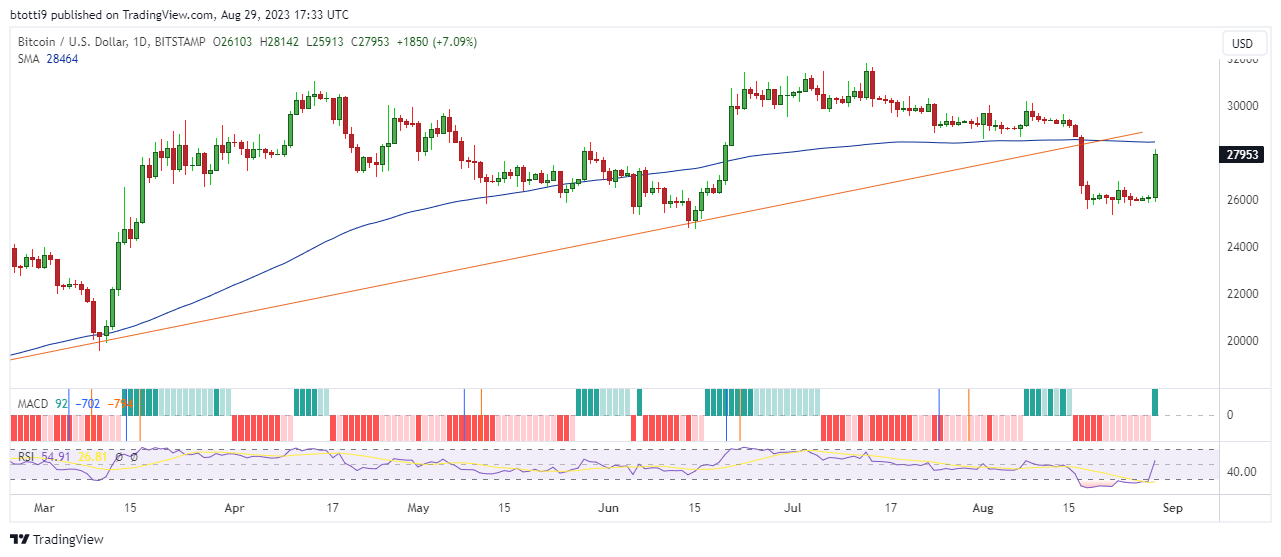

Bitcoin crosses the $27k mark

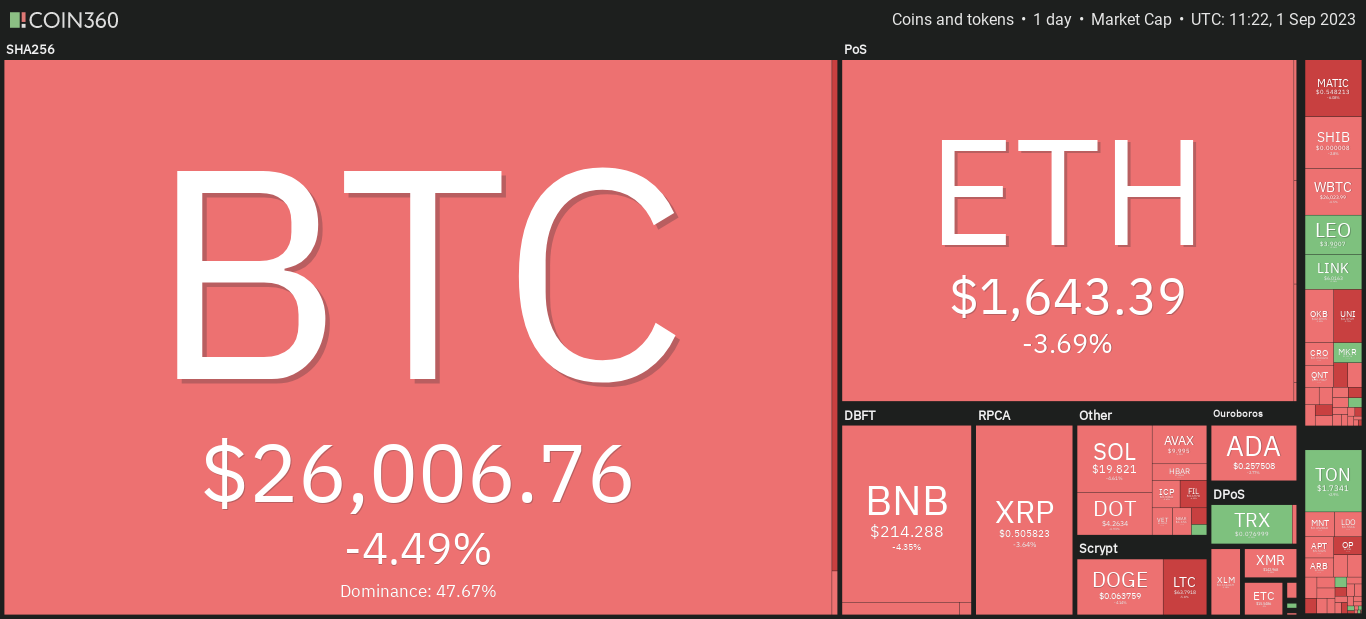

Bitcoin, the world’s leading cryptocurrency by market cap, has been performing well in recent days. It added more than 2% to its value over the past 24 hours as the rally continues.

At press time, the price of Bitcoin stands at $27,290, up by 2.6% so far today. Bitcoin’s positive performance has also seen the broader crypto market embark on a mini rally. The total cryptocurrency market cap now stands at $1.08 trillion, up by more than 2% in the last 24 hours.

What is Shiba Memu?

With the broader crypto market currently in a bullish mode, Shiba Memu’s presale has also been going excellently. Shiba Memu’s presale is closing in on a new milestone after adding more than $300k over the last few days.

Shiba Memu is a meme token project that combines AI and blockchain technology to create an unstoppable, entirely self-sufficient marketing powerhouse.

According to the development team, Shiba Memu is designed to handle the work of various marketing strategies. As an AI-based platform, Shiba Memu will be active at all times.

The Shiba Memu platform will always be active in finding the best creative advertising campaigns, making it easier for entities and individuals to carry out marketing campaigns.

Shiba Memu was launched as a meme project thanks to the recent popularity of meme coins. Over the last three years, the market cap of meme coins grew from practically $0 to reach the $20 billion mark in 2022.

While most meme coins lack use cases, Shiba Memu is built differently. Shiba Memu has utility and will solve real-world problems for companies and individuals.

In their whitepaper, the team said Shiba Memu has self-sufficient marketing capabilities powered by AI technology. As an AI-powered platform, Shiba Memu will develop its own marketing strategies, write its own PR, and promote itself in relevant forums and social networks. Shiba Memu currently operates on two major blockchains, Ethereum and BNB Chain

Shiba Memu’s presale nears $3m

Shiba Memu’s presale continues to set new records, adding more than $300k over the past seven days. Last week, Shiba Memu’s presale investment stood at $2.6m, and it currently stands at $2.9m.

The funds generated from the presale would be directed towards the development of some Shiba Memu products. Most of the funds would be used to develop Shiba Memu’s AI technology.

Click here to find out more about Shiba Memu’s presale event.

Should you invest in Shiba Memu today?

Shiba Memu’s presale continues to generate more interest thanks to the project’s value proposition. In addition to that, the cryptocurrency market has experienced an excellent performance since the start of the year, with the prices of most coins and tokens up by nearly 40% during that period.

Despite the positive performance, the market is still down by more than 50% from the all-time high set in 2021. Market analysts are now expecting Bitcoin and other cryptocurrencies to rally over the next few months.

Shiba Memu could be one of the biggest winners once the project launches and the token gets listed on crypto exchanges.

Shiba Memu is set to combine the powers of AI and blockchain technology to ease marketing strategies for companies and individuals. If the project gets the right level of adoption, its SHMU token could rally higher in the medium to long term.